THE WOODLANDS, Texas, Nov. 10, 2021 /PRNewswire/ -- CSI Compressco LP (NASDAQ: CCLP) ("CSI" or "Partnership")—along with CSI Compressco GP LLC, its general partner (the "General Partner")—today announced the execution of agreements resulting in a series of transactions (collectively, the "Transactions") that enable CSI to redeem all its outstanding Senior Unsecured Notes due 2022 (the "2022 Notes"). CSI is also releasing its third quarter 2021 results.

CSI will host a conference call to discuss third quarter results tomorrow, November 11, 2021, at 10:30 a.m. Eastern Time. The phone number for the call is 1-866-374-8397. The conference call will also be available by live audio webcast and may be accessed through CSI's website at www.csicompressco.com. An audio replay of the conference call will be available at 1-877-344-7529, conference number 10162088, for one week following the conference call and the archived webcast will be available through CSI's website for thirty days following the conference call.

In connection with this release, CSI has posted private placement materials provided to the equity investors on its website. Please visit the Investor Relations tab for further information.

Transaction Summary

- CSI raises $57 million in private placements of common units

- CSI acquires the primary operating business of Spartan Energy Partners LP ("Spartan") in an all equity transaction, with an expected increase in EBITDA of approximately 20%

- Announces redemption of all of its outstanding 2022 Notes, resulting in no bond maturities until 2025 after such redemption

- Reduces net leverage ratio on a pro forma basis from 6.8x to 5.5x as of September 30, 2021

- Improves liquidity from $35 million to $54 million on a pro forma basis as of September 30, 2021, a 54% increase

CSI raises $57 million in private placements of common units

- Equity of $57 million raised through private placements of the Partnership's common units

- Investors include new 3rd party institutional investors, existing unitholders (including Spartan), and management

- 42.0 million units sold at $1.35 per unit and subject to a 90 day lock up

CSI acquires primary operating business of Spartan in an all equity transaction, with an expected increase in EBITDA of approximately 20%

- Includes over 400 gas treating, cooling and processing assets and customer contracts

- CSI issued 48,400,000 common units and assumed approximately $32.5 million in debt as consideration

- The General Partner agrees to eliminate Incentive Distribution Rights, increasing sponsor alignment

Announces redemption of all of its outstanding 2022 Notes, leaving no bond maturities until 2025 after such redemption

- Reduces bond interest expense by approximately 10%

- Issues $10 million of senior secured second lien notes at par

- Includes exchange of $2 million of 2022 Notes held by Spartan for common units

- Next bond maturity is the senior secured first lien notes due in April of 2025

Reduces net leverage and improves liquidity

- The Spartan operations and entities acquired in the Transactions are supported by an Asset Backed Loan (the "Spartan ABL") that, pro forma for the Transactions, has a $70 million borrowing base and approximately $57.1 million drawn on a pro forma basis as of September 30, 2021

- The acquired Spartan entities will be designated unrestricted subsidiaries of the Partnership

- $24.4 million drawn from the Spartan ABL and combined with CSI sources will be used to redeem the 2022 Notes in full

- Leverage reduced by approximately 1.3x and liquidity increases by approximately $19 million on a pro forma basis as of September 30, 2021

Sources and Uses

($ millions) | ||

Sources | ||

Private Common Equity Sale | $ 56.7 | |

Spartan ABL Draw | 24.4 | |

Exchange of 2022 Notes for Common Equity | 2.4 | |

2026 2nd Lien Secured Notes Issuance | 10.0 | |

Total Sources | $ 93.4 | |

Uses | ||

Redemption of 2022 Notes and Accrued Interest | $ 82.6 | |

Transaction Fees | 4.5 | |

Additional Cash on Balance Sheet | 6.3 | |

Total Uses | $ 93.4 | |

The transaction was unanimously approved by the board of directors of the General Partner. The Conflicts Committee of the board of directors of the General Partner, consisting solely of independent directors, provided special approval for the terms of the contribution of the Spartan entities and operations to the Partnership.

Management Commentary:

John Jackson, CEO of CSI and Spartan, commented, "We are excited about how these transactions position CSI for the future. When Spartan acquired the General Partner and 23% of the outstanding common units in January 2021, we said our immediate focus would be on delivering quality service to our customers, generating liquidity, and improving our capital structure. Our operations team has worked hard to provide exceptional service to our customers in an improving market while contending with supply chain and labor issues. These transformational transactions are a significant step toward increasing liquidity, improving our capital structure, and positioning CSI for growth. It represents a serious commitment by Spartan's ownership to support CSI and position it to participate in the anticipated commodity price upcycle without further complicating the balance sheet. With the maturity of the 2022 Notes behind the Partnership, management can now fully turn its attention to execution, sound capital allocation decisions, and additional steps that will further strengthen the balance sheet."

"In addition to the financial benefits noted above, there are strategic benefits as well. The acquisition of the Spartan entities is expected to increase CSI's EBITDA by approximately 20% on a pro forma basis resulting in a significant reduction of CSI's leverage ratio. The Spartan ABL provides relatively inexpensive debt that will be used together with other sources of cash to fully redeem the 2022 Notes and help fund growth capital. Strategically, Spartan's business is a good fit for CSI as we have a highly complementary customer and asset base. We have already capitalized on some cross-selling opportunities benefitting both companies. As we now are able to fully integrate CSI and Spartan into one platform, we expect this activity to accelerate."

Advisors: Jefferies served as exclusive financial advisor to the Partnership on the Transactions and sole placement agent for the private placement common unit sale. Vinson & Elkins L.L.P. served as legal advisor to the Partnership. The Conflicts Committee engaged Evercore as its financial advisor and Shearman & Sterling LLP as its legal advisor.

Third Quarter 2021 Results:

- Total revenues for the third quarter 2021 were $71.3 million, compared to $69.8 million in the second quarter 2021.

- Compression and related services revenue increased sequentially to $56.4 million in the third quarter 2021 compared to $55.3 million in the second quarter 2021.

- Net loss was $14.4 million compared to a net loss of $12.1 million in the second quarter 2021.

- Adjusted EBITDA was $21.1 million compared to $23.1 million in the second quarter 2021. The third quarter of 2021 Adjusted EBITDA included a $1.0 million benefit from the sale of used equipment compared to a $0.1 million benefit in the second quarter 2021.

- Distributable cash flow was $5.7 million compared to $6.5 million in the second quarter 2021.

- Distribution coverage ratio was 11.8x in the third quarter 2021 compared to 13.3x in the second quarter 2021.

- Third quarter of 2021 distribution of $0.01 per common unit will be paid on November 12, 2021.

Management Commentary:

John Jackson, CEO of CSI and Spartan, commented, "The third quarter continued a trend of increasing utilization and improving revenue. The overall demand appears to be strong and the outlook for 2022 remains very upbeat for our industry. We are redeploying a sizeable amount of horsepower in a short amount of time. This activity level, combined with labor and supply chain issues, has increased our make ready and start-up expenses well above our normal levels. We expect these costs to revert to normal during the 1st quarter of 2022 as we begin to level out our deployment of idle units. In addition, we incurred some one-time costs in the 3rd quarter associated with transitioning our employee benefit plans from a shared service model provided by TETRA to stand alone at CSI. These costs are behind us after the 3rd quarter. On a combined basis, the make ready and transition costs accounted for approximately $2 million of costs that either have been eliminated or will begin to decline in Q1 2022. As a result, we remain very upbeat about 2022 as an industry and our ability to grow and participate in this upward market."

Net cash provided by operating activities was $22.9 million in the third quarter, compared to net cash used in operating activities of $9.7 million in the second quarter. Distributable cash flow in the third quarter was $5.7 million, resulting in a distribution coverage ratio of 11.8x.

This press release includes the following financial measures that are not presented in accordance with generally accepted accounting principles in the United States ("U.S. GAAP"): Adjusted EBITDA, distributable cash flow, distribution coverage ratio, free cash flow, and net leverage ratio. Please see Schedules B-E for reconciliations of these non-GAAP financial measures to the most directly comparable U.S. GAAP measures.

Unaudited results of operations for the quarter ended September 30, 2021 compared to the prior quarter and the corresponding prior year quarter are presented in the table below.

Three Months Ended | |||||||||||||||||

Sep 30, | Jun 30, | Sep 30, | Q3-2021 v | Q3-2021 v | |||||||||||||

(In Thousands, except percentage changes) | |||||||||||||||||

Net loss | $ | (14,362) | $ | (12,085) | $ | (12,607) | (19) | % | (14) | % | |||||||

Adjusted EBITDA | $ | 21,056 | $ | 23,085 | $ | 27,769 | (9) | % | (24) | % | |||||||

Distributable cash flow | $ | 5,735 | $ | 6,486 | $ | 10,512 | (12) | % | (45) | % | |||||||

Net cash provided by (used in) operating activities | $ | 22,884 | $ | (9,686) | $ | (4,451) | 336 | % | 614 | % | |||||||

Free cash flow | $ | 15,918 | $ | (15,056) | $ | 14,099 | 206 | % | 13 | % | |||||||

As of September 30, 2021, total compressor fleet horsepower was 1,175,989 and fleet horsepower in service was 928,303 for an overall fleet utilization rate of 78.9% (we define the overall service fleet utilization rate as the service compressor fleet horsepower in service divided by the total compressor fleet horsepower). Idle horsepower equipment under repair is not considered utilized, but we do count units on standby as utilized when the client is being billed a standby service rate.

Balance Sheet

Cash on hand at the end of the third quarter was $23.5 million. No amounts were drawn nor outstanding on the Partnership's asset-based loan at the end of the third quarter. Our debt consists of $80.7 million of unsecured bonds due in August 2022, $400.0 million of first lien secured bonds due in 2025 and $159.9 million of second lien secured bonds due in 2026. Net leverage ratio at the end of the quarter was 6.8X.

Capital Expenditures - 2021 Expectations

We expect capital expenditures for 2021 to be between $50.0 million and $60.0 million. The forecast includes between $28.0 million and $35.0 million for capital growth. Maintenance capital expenditures are expected to be between $18.0 million and $20.0 million. Investments in the Helix digitally enhanced compression system and other technologies are expected to be between $4.0 million and $5.0 million.

Third Quarter 2021 Cash Distribution on Common Units

On October 15, 2021, the board of directors of our General Partner declared a cash distribution attributable to the quarter ended September 30, 2021 of $0.01 per outstanding common unit. This distribution equates to a distribution of $0.04 per outstanding common unit on an annualized basis. This distribution will be paid on November 12, 2021 to each of the holders of common units of record as of the close of business on October 25, 2021. The distribution coverage ratio for the third quarter of 2021 was 11.8x.

Conference Call

CSI will host a conference call to discuss third quarter results tomorrow, November 11, 2021, at 10:30 a.m. Eastern Time. The phone number for the call is 1-866-374-8397. The conference call will also be available by live audio webcast and may be accessed through CSI's website at www.csicompressco.com. An audio replay of the conference call will be available at 1-877-344-7529, conference number 10162088, for one week following the conference call and the archived webcast will be available through CSI's website for thirty days following the conference call.

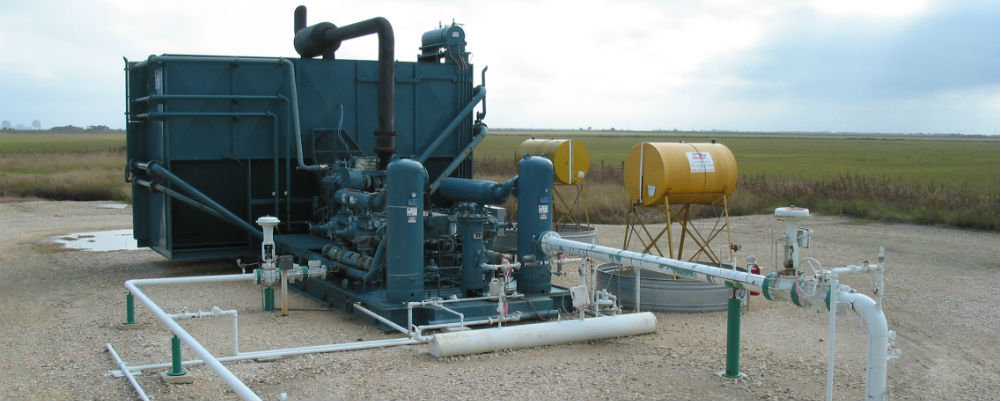

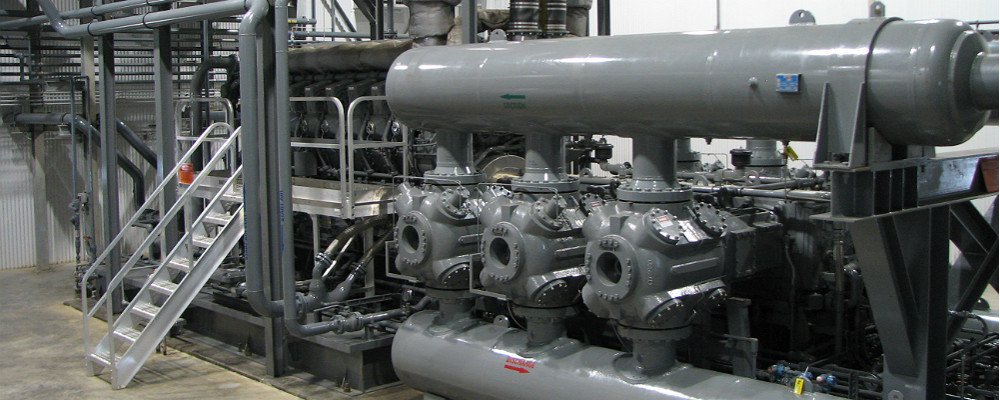

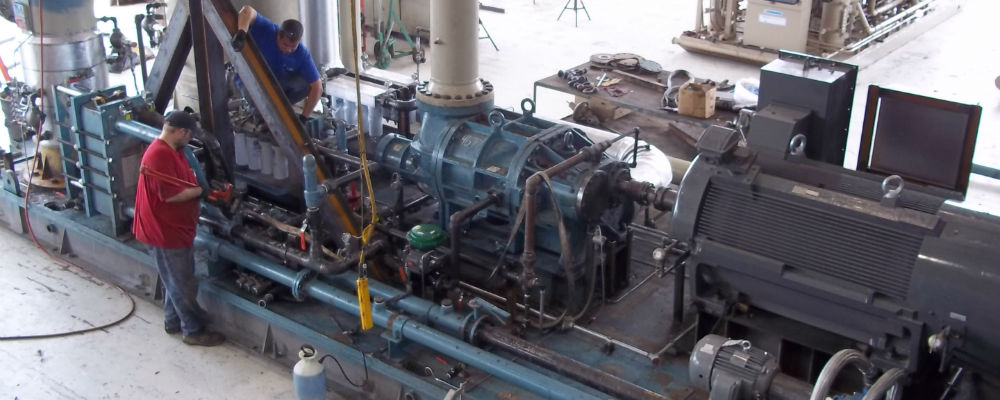

CSI Overview

CSI is a provider of compression services and equipment for natural gas and oil production, gathering, artificial lift, transmission, processing, and storage. CSI's compression and related services business includes a fleet of approximately 4,900 compressor packages providing approximately 1.2 million in aggregate horsepower, utilizing a full spectrum of low-, medium- and high-horsepower engines. CSI also provides well monitoring and automated sand separation services in conjunction with compression and related services in Mexico. CSI's aftermarket business provides compressor package reconfiguration and maintenance services. CSI's customers comprise a broad base of natural gas and oil exploration and production, midstream, transmission, and storage companies operating throughout many of the onshore producing regions of the United States, as well as in a number of foreign countries, including Mexico, Canada and Argentina. CSI's general partner is owned by Spartan Energy Partners.

Forward-Looking Statements

This news release contains "forward-looking statements" and information based on our beliefs and those of our general partner, CSI Compressco GP LLC. Forward-looking statements in this news release are identifiable by the use of the following words and other similar words: "anticipates," "assumes," "believes," "budgets," "could," "estimates," "expectations," "expects," "forecasts," "goal," "intends," "may," "might," "plans," "predicts," "projects," "schedules," "seeks," "should," "targets," "will," and "would." These forward-looking statements include statements, other than statements of historical fact, including the completion of the Transactions and their estimated impact on the results of operation of CSI, anticipated return of standby equipment to in service, the redeployment of idle fleet compressors, joint-bidding on potential projects with Spartan, commodity prices and demand for CSI's equipment and services and other statements regarding CSI's beliefs, expectations, plans, prospects and other future events, performance, and other statements that are not purely historical. Such forward-looking statements reflect our current views with respect to future events and financial performance, and are based on assumptions that we believe to be reasonable, but such forward-looking statements are subject to numerous risks and uncertainties, including but not limited to: economic and operating condition that are outside of our control, including the trading price of our common units; the severity and duration of the COVID-19 pandemic and related economic repercussions and the resulting negative impact on the demand for oil and gas, operational challenges relating to the COVID-19 pandemic and efforts to mitigate the spread of the virus, including logistical challenges, remote work arrangements, and supply chain disruptions, other global or national health concerns; the current significant surplus in the supply of oil and the ability of OPEC and other oil producing nations to agree on and comply with supply limitations; the duration and magnitude of the unprecedented disruption in the oil and gas industry; the levels of competition we encounter; our dependence upon a limited number of customers and the activity levels of our customers; our ability to replace our contracts with our customers, which are generally short-term contracts; the availability of adequate sources of capital to us; our existing debt levels and our ability to obtain additional financing or refinancing; our ability to continue to make cash distributions, or increase cash distributions from current levels, after the establishment of reserves, payment of debt service and other contractual obligations; the restrictions on our business that are imposed under our long-term debt agreements; our operational performance; the credit and risk profile of Spartan Energy Partners; ability of our general partner to retain key personnel; risks related to acquisitions and our growth strategy; the availability of raw materials and labor at reasonable prices; risks related to our foreign operations; the effect and results of litigation, regulatory matters, settlements, audits, assessments, and contingencies; or potential material weaknesses in the future; information technology risks, including the risk of cyberattack; and other risks and uncertainties contained in our Annual Report on Form 10-K and our other filings with the U.S. Securities and Exchange Commission ("SEC"), which are available free of charge on the SEC website at www.sec.gov. The risks and uncertainties referred to above are generally beyond our ability to control and we cannot predict all the risks and uncertainties that could cause our actual results to differ from those indicated by the forward-looking statements. If any of these risks or uncertainties materialize, or if any of the underlying assumptions prove incorrect, actual results may vary from those indicated by the forward-looking statements, and such variances may be material. All subsequent written and verbal forward-looking statements made by or attributable to us or to persons acting on our behalf are expressly qualified in their entirety by reference to these risks and uncertainties. You should not place undue reliance on forward-looking statements. Each forward-looking statement speaks only as of the date of the particular statement, and we undertake no obligation to update or revise any forward-looking statements we may make, except as may be required by law.

Reconciliation of Non-GAAP Financial Measures

The Partnership includes in this release the non-GAAP financial measures Adjusted EBITDA, distributable cash flow, distribution coverage ratio, free cash flow, and net leverage ratio. Adjusted EBITDA is used as a supplemental financial measure by the Partnership's management to:

- assess the Partnership's ability to generate available cash sufficient to make distributions to the Partnership's unitholders and general partner;

- evaluate the financial performance of its assets without regard to financing methods, capital structure or historical cost basis;

- measure operating performance and return on capital as compared to those of our competitors; and

- determine the Partnership's ability to incur and service debt and fund capital expenditures.

The Partnership defines Adjusted EBITDA as earnings before interest, taxes, depreciation and amortization, and before certain charges, including impairments, bad debt expense attributable to bankruptcy of customers, equity compensation, non-cash costs of compressors sold, gain on extinguishment of debt, write-off of unamortized financing costs, and excluding, severance and other non-recurring or unusual expenses or charges.

Distributable cash flow is used as a supplemental financial measure by the Partnership's management, as it provides important information relating to the relationship between our financial operating performance and our cash distribution capability. Additionally, the Partnership uses distributable cash flow in setting forward expectations and in communications with the board of directors of our general partner. The Partnership defines distributable cash flow as Adjusted EBITDA less current income tax expense, maintenance capital expenditures, interest expense, and severance expense, plus non-cash interest expense.

The Partnership believes that the distribution coverage ratio provides important information relating to the relationship between the Partnership's financial operating performance and its cash distribution capability. The Partnership defines the distribution coverage ratio as the ratio of distributable cash flow to the total quarterly distribution payable, which includes, as applicable, distributions payable on all outstanding common units, the general partner interest and the general partner's incentive distribution rights.

The Partnership defines free cash flow as net cash provided by operating activities less capital expenditures, net of sales proceeds. Management primarily uses this metric to assess our ability to retire debt, evaluate our capacity to further invest and grow, and measure our performance as compared to our peer group of companies.

The Partnership defines net leverage ratio as net debt (the sum of the carrying value of long-term and short-term debt on its consolidated balance sheet, less cash, excluding restricted cash on the consolidated balance sheet and excluding outstanding letters of credit) divided by Adjusted EBITDA for calculating net leverage (Adjusted EBITDA as reported externally adjusted for certain items to comply with its credit agreement) for the trailing twelve-month period. Management primarily uses this metric to assess the Partnership's ability to borrow, reduce debt, add to cash balances, pay distributions, and fund investing and financing activities.

These non-GAAP financial measures should not be considered an alternative to net income, operating income, cash flows from operating activities or any other measure of financial performance presented in accordance with U.S. GAAP. These non-GAAP financial measures may not be comparable to Adjusted EBITDA, distributable cash flow, free cash flow or other similarly titled measures of other entities, as other entities may not calculate these non-GAAP financial measures in the same manner as CSI. Management compensates for the limitation of these non-GAAP financial measures as an analytical tool by reviewing the comparable U.S. GAAP measures, understanding the differences between the measures and incorporating this knowledge into management's decision-making process. Furthermore, these non-GAAP measures should not be viewed as indicative of the actual amount of cash that CSI has available for distributions or that the Partnership plans to distribute for a given period, nor should they be equated to available cash as defined in the Partnership's partnership agreement.

Schedule A - Income Statement | |||||||||||||||||||

Results of Operations (unaudited) | |||||||||||||||||||

Three Months Ended | Nine Months Ended | ||||||||||||||||||

Sep 30, 2021 | Jun 30, 2021 | Sep 30, 2020 | Sep 30, 2021 | Sep 30, 2020 | |||||||||||||||

(In Thousands, Except per Unit Amounts) | |||||||||||||||||||

Revenues: | |||||||||||||||||||

Compression and related services | $ | 56,388 | $ | 55,329 | $ | 53,367 | $ | 165,956 | $ | 175,416 | |||||||||

Aftermarket services | 13,952 | 14,289 | 13,862 | 39,242 | 47,569 | ||||||||||||||

Equipment sales | 954 | 140 | 5,029 | 1,564 | 7,478 | ||||||||||||||

Total revenues | $ | 71,294 | $ | 69,758 | $ | 72,258 | $ | 206,762 | $ | 230,463 | |||||||||

Cost of revenues (excluding depreciation and amortization expense): | |||||||||||||||||||

Cost of compression and related services | $ | 29,040 | $ | 26,597 | $ | 25,133 | $ | 82,063 | $ | 82,136 | |||||||||

Cost of aftermarket services | 11,864 | 11,959 | 11,815 | 33,340 | 41,493 | ||||||||||||||

Cost of equipment sales | 1,492 | 29 | 4,820 | 1,838 | 7,407 | ||||||||||||||

Total cost of revenues | $ | 42,396 | $ | 38,585 | $ | 41,768 | $ | 117,241 | $ | 131,036 | |||||||||

Depreciation and amortization | 18,695 | 18,997 | 19,896 | 56,222 | 59,446 | ||||||||||||||

Impairments of long-lived assets | — | — | — | — | 8,874 | ||||||||||||||

Insurance recoveries | — | — | — | — | (517) | ||||||||||||||

Selling, general, and administrative expense | 9,433 | 9,116 | 7,973 | 28,143 | 26,304 | ||||||||||||||

Interest expense, net | 13,951 | 13,932 | 13,886 | 41,781 | 40,635 | ||||||||||||||

Other (income) expense, net | 395 | (97) | (516) | 622 | 4,327 | ||||||||||||||

Loss before taxes and discontinued operations | $ | (13,576) | $ | (10,775) | $ | (10,749) | $ | (37,247) | $ | (39,642) | |||||||||

Provision for income taxes | 516 | 1,019 | 715 | 3,042 | 1,872 | ||||||||||||||

Loss from continuing operations | $ | (14,092) | $ | (11,794) | $ | (11,464) | $ | (40,289) | $ | (41,514) | |||||||||

Loss from discontinued operations, net of taxes | $ | (270) | (291) | (1,143) | (623) | (9,301) | |||||||||||||

Net loss | $ | (14,362) | (12,085) | (12,607) | (40,912) | (50,815) | |||||||||||||

Net loss per basic and diluted common unit | $ | (0.30) | $ | (0.25) | $ | (0.25) | $ | (0.84) | $ | (1.05) | |||||||||

Schedule B - Reconciliation of Net Loss to Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio | |||||||||||||||||||

The following table reconciles net loss to Adjusted EBITDA, distributable cash flow and distribution coverage ratio for the three and nine month periods ended September 30, 2021, June 30, 2021 and September 30, 2020: | |||||||||||||||||||

Results of Operations (unaudited) | |||||||||||||||||||

Three Months Ended | Nine Months Ended | ||||||||||||||||||

Sep 30, 2021 | Jun 30, 2021 | Sep 30, 2020 | Sep 30, 2021 | Sep 30, 2020 | |||||||||||||||

(In Thousands, except Ratios) | |||||||||||||||||||

Net loss | $ | (14,362) | $ | (12,085) | $ | (12,607) | $ | (40,912) | $ | (50,815) | |||||||||

Interest expense, net | 13,951 | 13,932 | 13,886 | 41,781 | 40,635 | ||||||||||||||

Provision for income taxes | 516 | 1,019 | 715 | 3,042 | 1,872 | ||||||||||||||

Depreciation and amortization | 18,695 | 18,997 | 19,896 | 56,222 | 59,446 | ||||||||||||||

Impairments of fixed assets and inventory | — | — | — | — | 8,874 | ||||||||||||||

Non-cash cost of compressors sold | 1,423 | 78 | 4,804 | 1,861 | 7,244 | ||||||||||||||

Equity compensation | 497 | 477 | 232 | 1,807 | 1,044 | ||||||||||||||

Bond exchange expenses | — | — | 22 | — | 4,777 | ||||||||||||||

Prior year sales tax accrual adjustment | — | 367 | — | 367 | — | ||||||||||||||

Manufacturing engine order cancellation charge | — | 300 | — | 300 | — | ||||||||||||||

Severance | — | — | 484 | 114 | 1,840 | ||||||||||||||

Provision for income taxes, depreciation, | — | — | 31 | — | 6,051 | ||||||||||||||

Other | 336 | — | 306 | 644 | 1,610 | ||||||||||||||

Adjusted EBITDA | $ | 21,056 | $ | 23,085 | $ | 27,769 | $ | 65,226 | $ | 82,578 | |||||||||

Less: | |||||||||||||||||||

Current income tax expense | 341 | 417 | 516 | 1,859 | 1,335 | ||||||||||||||

Maintenance capital expenditures | 2,811 | 3,685 | 4,354 | 9,936 | 14,795 | ||||||||||||||

Interest expense | 13,951 | 13,932 | 13,886 | 41,781 | 40,635 | ||||||||||||||

Severance and other | 336 | 667 | 790 | 1,425 | 3,450 | ||||||||||||||

Plus: | |||||||||||||||||||

Non-cash items included in interest expense | 2,118 | 2,102 | 2,289 | 6,318 | 5,010 | ||||||||||||||

Distributable cash flow | $ | 5,735 | $ | 6,486 | $ | 10,512 | $ | 16,543 | $ | 27,373 | |||||||||

Cash distribution attributable to period | $ | 487 | $ | 487 | $ | 480 | $ | 1,458 | $ | 1,438 | |||||||||

Distribution coverage ratio | 11.8x | 13.3x | 21.9x | 11.4x | 19x | ||||||||||||||

Schedule C - Reconciliation of Net Cash Provided by Operating Activities Operations to Free Cash Flow | |||||||||||||||||||

The following table reconciles net cash provided by operating activities to free cash flow for the three and nine month periods ended September 30, 2021, June 30, 2021 and September 30, 2020: | |||||||||||||||||||

Results of Operations (unaudited) | |||||||||||||||||||

Three Months Ended | Nine Months Ended | ||||||||||||||||||

Sep 30, 2021 | Jun 30, 2021 | Sep 30, 2020 | Sep 30, 2021 | Sep 30, 2020 | |||||||||||||||

(In Thousands) | |||||||||||||||||||

Net cash provided by (used in) operating activities | $ | 22,884 | $ | (9,686) | $ | (4,451) | $ | 22,812 | $ | 13,729 | |||||||||

Capital expenditures, net of sales proceeds | (6,966) | (5,370) | 1,550 | (16,815) | (6,058) | ||||||||||||||

Midland proceeds | $ | — | $ | — | $ | 17,000 | $ | — | $ | 17,000 | |||||||||

Free cash flow | $ | 15,918 | $ | (15,056) | $ | 14,099 | $ | 5,997 | $ | 24,671 | |||||||||

Schedule D – Reconciliation to Adjusted EBITDA Margin (unaudited) | |||||||||||||||||||

Three Months Ended | Nine Months Ended | ||||||||||||||||||

Sep 30, 2021 | Jun 30, 2021 | Sep 30, 2020 | Sep 30, 2021 | Sep 30, 2020 | |||||||||||||||

Consolidated | (In Thousands, except Margin %) | ||||||||||||||||||

Revenue | $ | 71,294 | $ | 69,758 | $ | 72,258 | $ | 206,762 | $ | 230,463 | |||||||||

Loss before taxes and discontinued operations | $ | (13,576) | $ | (10,775) | $ | (10,749) | $ | (37,247) | $ | (39,642) | |||||||||

Adjusted loss margin before taxes and discontinued operations | (19.0) | % | (15.4) | % | (14.9) | % | (18.0) | % | (17.2) | % | |||||||||

Adjusted EBITDA (Schedule B) | $ | 21,056 | $ | 23,085 | $ | 27,769 | $ | 65,226 | $ | 82,578 | |||||||||

Adjusted EBITDA Margin | 29.5 | % | 33.1 | % | 38.4 | % | 31.5 | % | 35.8 | % | |||||||||

Schedule E – Reconciliation of Net Loss to Adjusted EBITDA for Net Leverage Ratio Calculation (unaudited) | |||

(in thousands, except ratios) | |||

Twelve Months | |||

Sep 30, 2021 | |||

Net loss | $ | (63,937) | |

Interest expense, net | 55,614 | ||

Provision for income taxes | 4,315 | ||

Depreciation and amortization | 76,783 | ||

Impairments and other charges | 6,493 | ||

Non-cash cost of compressors sold | 7,429 | ||

Equity Compensation | 2,152 | ||

Sales tax adjustment affecting prior periods | 115 | ||

Prior year sales tax accrual adjustment | 367 | ||

Manufacturing engine order cancellation charge | 300 | ||

Severance | 308 | ||

Other | 1,472 | ||

Adjusted EBITDA | $ | 91,411 | |

EBITDA adjustments to comply with Credit Agreement | 207 | ||

Adjusted EBITDA for Net Leverage Calculation | $ | 91,618 | |

Debt Schedule | Sep 30, 2021 | ||

7.25% Senior Notes | 80,722 | ||

7.50% First Lien Notes | 400,000 | ||

10.00%/10.75% Second Lien Notes | 159,919 | ||

Asset Based Loan | — | ||

Letters of Credit | 2,114 | ||

Cash on Hand | (23,484) | ||

Net Debt | $ | 619,271 | |

Net Leverage Ratio (Net Debt/Adjusted EBITDA for Net Leverage Calculation) | 6.8x | ||

Schedule F – Balance Sheet | |||||||

September 30, | December 31, | ||||||

(in thousands) | (Unaudited) | ||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 23,484 | $ | 16,577 | |||

Trade accounts receivable, net of allowances for doubtful accounts of $862 as of | 48,182 | 43,837 | |||||

Inventories | 31,894 | 31,188 | |||||

Prepaid expenses and other current assets | 6,266 | 5,184 | |||||

Current assets associated with discontinued operations | 7 | 39 | |||||

Total current assets | 109,833 | 96,825 | |||||

Property, plant, and equipment: | |||||||

Land and building | 13,266 | 13,259 | |||||

Compressors and equipment | 989,386 | 975,375 | |||||

Vehicles | 7,653 | 7,692 | |||||

Construction in progress | 14,274 | 12,763 | |||||

Total property, plant, and equipment | 1,024,579 | 1,009,089 | |||||

Less accumulated depreciation | (504,094) | (457,688) | |||||

Net property, plant, and equipment | 520,485 | 551,401 | |||||

Other assets: | |||||||

Intangible assets, net of accumulated amortization of $32,932 as of September 30, | 22,836 | 25,057 | |||||

Operating lease right-of-use assets | 27,136 | 32,637 | |||||

Deferred tax asset | 10 | 10 | |||||

Other assets | 3,423 | 4,036 | |||||

Total other assets | 53,405 | 61,740 | |||||

Total assets | $ | 683,723 | $ | 709,966 | |||

LIABILITIES AND PARTNERS' CAPITAL | |||||||

Current liabilities: | |||||||

Accounts payable | $ | 23,923 | $ | 19,766 | |||

Accrued liabilities and other | 48,484 | 36,070 | |||||

Amounts payable to affiliates | 2,907 | 3,234 | |||||

Current portion of long-term debt | 80,331 | — | |||||

Current liabilities associated with discontinued operations | 140 | 345 | |||||

Total current liabilities | 155,785 | 59,415 | |||||

Other liabilities: | |||||||

Long-term debt, net | 560,874 | 638,631 | |||||

Deferred tax liabilities | 2,624 | 1,478 | |||||

Long-term affiliate payable | 11,107 | — | |||||

Operating lease liabilities | 19,187 | 24,059 | |||||

Other long-term liabilities | 555 | 11,716 | |||||

Total other liabilities | 594,347 | 675,884 | |||||

Commitments and contingencies | |||||||

Partners' capital: | |||||||

General partner interest | (1,475) | (885) | |||||

Common units (47,971,240 units issued and outstanding at September 30, 2021 | (50,527) | (10,055) | |||||

Accumulated other comprehensive income (loss) | (14,407) | (14,393) | |||||

Total partners' capital | (66,409) | (25,333) | |||||

Total liabilities and partners' capital | $ | 683,723 | $ | 709,966 | |||

SOURCE CSI Compressco LP