THE WOODLANDS, Texas, Aug. 7, 2019 /PRNewswire/ -- CSI Compressco LP ("CSI Compressco") (NASDAQ: CCLP) announced that revenue increased sequentially by 31%, net loss for the second quarter of 2019 improved to $2.9 million compared to a net loss of $12.5 million in the first quarter of 2019 and distributable cash flow(1) increased sequentially by 150% to $15.7 million while achieving record high compression services gross margins and utilization since the acquisition of Compressor Systems, Inc. in 2014.

Revenues for the quarter ended June 30, 2019 were $136 million compared to $103 million for the first quarter of 2019 and $100 million for the second quarter of 2018. The revenue increases were primarily from new equipment sales and stronger aftermarket services activity.

Selected key operational and financial metrics are as follows:

- Distributable cash flow(1) increased 150% to $15.7 million in the second quarter from $6.3 million in the first quarter of 2019. The coverage ratio on distributable cash flow(1) was 33.0X.

- Second quarter 2019 Adjusted EBITDA(1) of $32.8 million increased 22% over the first quarter of 2019.

- Compression services gross margins in the second quarter of 2019 improved 450 basis points (bps) to 52.7% from 48.2% in the first quarter of 2019, and represents a record high since the acquisition of Compressor Systems, Inc.(1)

- Overall service fleet utilization increased 190 bps to 89.1% from the end of the first quarter of 2019, which was also a record high since the acquisition of Compressor Systems, Inc. Utilization for high horsepower equipment (greater than 1,000 horsepower per unit) increased 150 bps from the end of the first quarter, to 97.1%. During the quarter we increased our active operating horsepower by more than 11,500 horsepower and we wrote-off 441 low horsepower GasJack units with a total of 20,286 horsepower.

- The final cash redemption of Series A Convertible Preferred Units will occur on August 8, 2019, after which all Series A Preferred Units will be fully redeemed.

(1) These measures are not presented in accordance with generally accepted accounting principles in the United States ("GAAP"). Please see Schedules B, C and D for reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures. |

Unaudited results of operations for the quarter ended June 30, 2019 compared to the prior quarter and the corresponding prior year quarter are presented in the following tables.

Three Months Ended | |||||||||

Jun 30, 2019 | Mar 31, 2019 | Jun 30, 2018 | Q2-19 vs. | Q2-19 vs. | |||||

Net loss | $ (2,947) | $ (12,456) | $ (9,592) | 76 % | 69 % | ||||

Adjusted EBITDA(1) | $ 32,763 | $ 26,805 | $ 23,262 | 22 % | 41 % | ||||

Distributable cash flow(1) | $ 15,727 | $ 6,298 | $ 5,216 | 150 % | 202 % | ||||

Quarterly cash distribution per unit | $ 0.01 | $ 0.01 | $ 0.1875 | - % | (95)% | ||||

Distribution coverage ratio(1) | 33.0x | 13.2x | 0.65x | ||||||

Fleet growth capital expenditures(2) | $ 11,901 | $ 17,578 | $ 25,753 | (32)% | (54)% | ||||

Cash from operating activities | $ 8,710 | $ 31,632 | $ (3,908) | (72)% | N/A | ||||

Free cash flow(1) | $ (7,724) | $ 8,480 | $ (34,131) | N/A | (77)% | ||||

(1) Non-GAAP financial measures reconciled to the nearest GAAP number on Schedules B and C. | |||||||||

(2) Includes capital expenditures paid by TETRA under backstop financing arrangement | |||||||||

Brady Murphy, interim President of CSI Compressco, commented, "The second quarter was our strongest sequential improvement in quarterly earnings since the downturn. We achieved several record highs, driven by continued and consistent improvements in compression services, aftermarket services and new unit sales. Adjusted EBITDA increased sequentially by 22% and was the highest Adjusted EBITDA since the fourth quarter of 2014."

Compression and Related Services

"Compression services continue to get stronger each quarter. The 450 bps improvement from first quarter of 2019 in gross margin for compression services was a function of several factors: (a) better pricing, (b) deploying new compression units at pricing that is generating 20% returns on capital, (c) focusing new capital on our core customers where we have concentrations of equipment that allow us to effectively leverage our field staff, and (d) cost initiatives that are being realized with our ERP system. Market demand for compression services continues to be very strong as we continue to see customers asking us for additional compression services into 2020. Given this continued demand for our compression services and high utilization of the fleet, we are continuing to achieve price increases as customer contracts roll over. As we continue our disciplined capital allocation policy, we are focusing our investments in new units to provide compression services to our core customers, who are major operators in key shale basins that require more equipment and compression services to perform both centralized gas lift and field gathering system capabilities to handle the continued high gas volumes. The need for centralized gas lift (utilizing multiple large horsepower compressors to service many wells drilled and producing in concentrated areas) continues to grow in support of initial early life oil production requirements and for enhanced oil recovery from those wells.

"We remain bullish on compression as the industry continues to require more equipment to handle increased gas production and the increasing trend for centralized gas lift.

"As of June 30, 2019, our aggregate service compressor package horsepower totaled 1,155,440 and the overall service fleet utilization rate was 89.1%, up 190 basis points from our exit utilization of 87.2% at March 31, 2019. Total aggregate operating service compressor package horsepower was 1,029,045 as of June 30, 2019 (we define the fleet utilization rate as the aggregate compressor package horsepower in service divided by the aggregate compressor package fleet horsepower as of such date). We do not exclude idle horsepower under repair from our calculation of utilization rates. In the second quarter of 2019 we took an impairment charge to write-off 441 low horsepower GasJack units with a total of 20,286 horsepower which we have decided to dispose. The utilization figures in this press release reflect this reduction in our aggregate fleet horsepower.

Aftermarket Services and Equipment Sales

"Our aftermarket services and equipment sales businesses experienced a strong rebound in the second quarter, consistent with our expectations. Second quarter orders for new equipment sales were $18 million, a significant increase over the $11 million in the first quarter of 2019. Although the pipeline of identified new unit sales opportunities remains in excess of $250 million, customers have delayed committing to new orders in the first half of the year, which has resulted in a decrease in our backlog. Our expectation is that new unit sales orders will rebound in the second half in order to meet our customers' 2020 delivery requirements. However, due to delays in new unit sales orders in the first half of the year, we expect our third quarter and fourth quarter equipment sales will be slightly lower than previously expected, but still above first quarter levels.

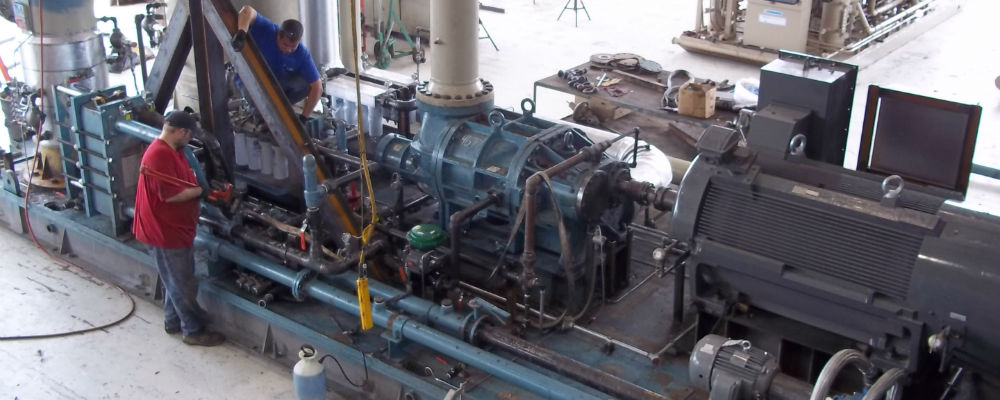

"Aftermarket services revenue of $18.2 million increased $4.6 million sequentially, or 34%, due to the timing of completion of major overhauls of our customers' equipment during the quarter. Based on our aftermarket services order book, we expect that this business will continue to get stronger as the year progresses, near the levels we experienced in the second half of last year.

Capital Allocation

"On August 8, 2019 we will complete the cash redemption of the Series A Convertible Preferred Units, freeing up free cash flow to focus on balanced growth and stakeholder returns. Most of the free cash flow that we expect to generate in the third quarter of 2019 is already committed for growth capital. We remain committed in the near term towards utilizing approximately 50% of free cash flow towards growth capital and 50% towards stakeholder returns, through either debt reduction or increased quarterly distributions. We remain committed to improving our balance sheet with a goal of reducing our leverage ratio to 4.5x, or better. The amount of cash directed towards distributions or reductions in debt will be assessed each quarter with our board of directors and will be driven by several factors, including how the unsecured bonds and how the common unit prices are trading in the market. As of June 30, 2019, we did not have any amounts drawn on our asset-based revolver. Total long-term debt outstanding is $296 million of unsecured bonds that mature in August 2022 and $350 million of secured bonds that mature in April 2025."

Forward-Looking Guidance

We expect consolidated 2019 revenue to be between $475 million and $490 million, compared to the previous guidance range of $490 million to $520 million reflecting a slowdown in customer orders for new equipment, partially offset by continued improvements in pricing for compression services. We expect 2019 net loss to be between $13.3 million and $15.2 million and Adjusted EBITDA to be between $125 million and $130 million, towards the lower range of previous guidance. We further expect that our average distribution coverage ratio for 2019 will be between 30X and 32X at the end of 2019 (assuming continuation of the current quarterly distribution amount) with aggregate 2019 distributable cash flow to be between $56 million and $60 million. Reconciliations of expected Adjusted EBITDA, distributable cash flow, free cash flow and distribution coverage ratio to the nearest GAAP financial measures are included on Schedule D.

We expect 2019 capital expenditures to be between $65 million to $70 million, which we expect to fund from cash on hand and cash flow from operations. This range includes $18 million to $20 million for maintenance capital expenditures and $47 million to $50 million of growth capital expenditures that would add approximately 86,000 of horsepower to the fleet in 2019, all with client commitments. The range of growth capital expenditures excludes $15 million of compressor packages, with 20,700 horsepower, that TETRA Technologies, Inc. ("TETRA") agreed to purchase and lease to CSI Compressco. In the first half of 2019, we invested approximately $31 million of capital expenditures, inclusive of maintenance capital expenditure and excluding approximately $11 million funded by TETRA. For accounting purposes, the $15 million of fleet additions funded by TETRA, will be reflected as capital expenditures. CSI Compressco has the right to buy the equipment any time over the next five years in accordance with the terms of the agreements with TETRA, and has no obligation to buy the equipment at the end of the five-year term. This support from TETRA will allow us to meet certain current client demands without having to borrow under our asset-based revolver or access the debt or equity markets.

Conference Call

CSI Compressco will host a conference call to discuss second quarter 2019 results today, August 7, 2019, at 10:30 a.m. Eastern Time. The phone number for the call is 1-866-374-8397. The conference will also be available by live audio webcast and may be accessed through CSI Compressco's website at www.csicompressco.com. An audio replay of the conference call will be available at 1-877-344-7529, conference number 10127837, for one week following the conference call and the archived webcast call will be available through the Company's website for 30 days following the conference call.

Second Quarter 2019 Cash Distribution on Common Units

On July 22, 2019, CSI Compressco announced that the board of directors of its general partner declared a cash distribution attributable to the second quarter of 2019 of $0.01 per outstanding common unit, which will be paid on August 14, 2019, to common unitholders of record as of the close of business on August 1, 2019. The distribution coverage ratio (which is a non-GAAP Financial Measure defined and reconciled to the closest GAAP financial measure on Schedule B below) for the second quarter of 2019 was 33.0X.

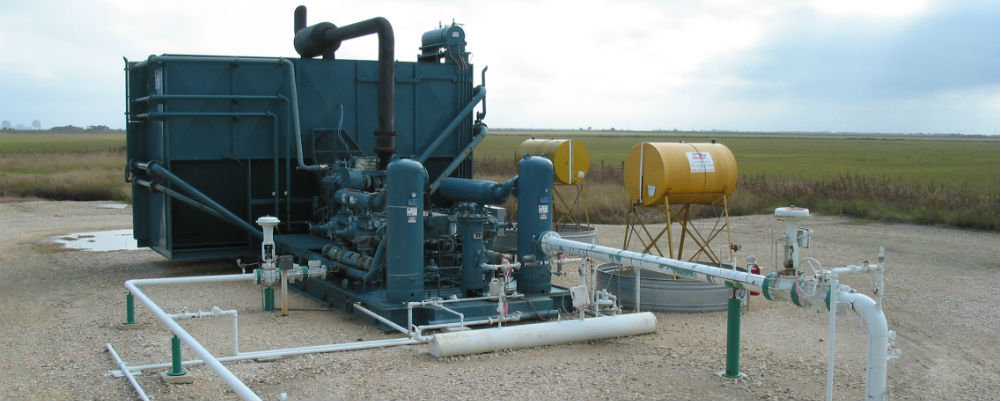

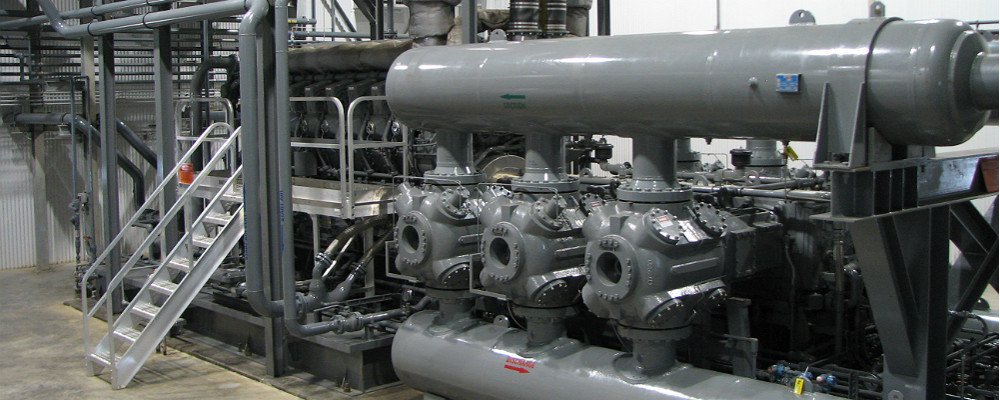

CSI Compressco Overview

CSI Compressco is a provider of compression services and equipment for natural gas and oil production, gathering, transportation, processing, and storage. CSI Compressco's compression and related services business includes a fleet of more than 5,300 compressor packages providing approximately 1.15 million in aggregate horsepower, utilizing a full spectrum of low, medium and high horsepower engines. CSI Compressco also provides well monitoring and automated sand separation services in conjunction with compression and related services in Mexico. CSI Compressco's equipment sales business includes the fabrication and sale of standard compressor packages and custom-designed compressor packages designed and fabricated primarily at our facility in Midland, Texas. CSI Compressco's aftermarket business provides compressor package reconfiguration and maintenance services, as well as the sale of compressor package parts and components manufactured by third-party suppliers. CSI Compressco's customers comprise a broad base of natural gas and oil exploration and production, mid-stream, transmission, and storage companies operating throughout many of the onshore producing regions of the United States, as well as in a number of foreign countries, including Mexico, Canada and Argentina. CSI Compressco is managed by CSI Compressco GP Inc., which is an indirect, wholly owned subsidiary of TETRA Technologies, Inc. (NYSE: TTI).

Forward-Looking Statements

This news release contains "forward-looking statements" and information based on our beliefs and those of our general partner, CSI Compressco GP Inc. Forward-looking statements in this news release are identifiable by the use of the following words and other similar words: "anticipates," "assumes," "believes," "budgets," "could," "estimates," "expectations," "expects," "forecasts," "goal," "intends," "may," "might," "plans," "predicts," "projects," "schedules," "seeks," "should," "targets," "will," and "would." These forward-looking statements include statements, other than statements of historical fact, concerning the recovery of the oil and gas industry and CSI Compressco's strategy, future operations, financial position, estimated revenues, negotiations with our bank lenders, projected costs, and other statements regarding CSI Compressco's beliefs, expectations, plans, prospects and other future events and performance. Such forward-looking statements reflect our current views with respect to future events and financial performance, and are based on assumptions that we believe to be reasonable, but such forward-looking statements are subject to numerous risks and uncertainties, including but not limited to: economic and operating conditions that are outside of our control, including the supply, demand and prices of crude oil and natural gas; the levels of competition we encounter; the activity levels of our customers; the availability of adequate sources of capital to us; our ability to comply with contractual obligations, including those under our financing arrangements; our operational performance; the loss of our management; risks related to acquisitions and our growth strategy; the availability of raw materials and labor at reasonable prices; risks related to our foreign operations; the effect and results of litigation, regulatory matters, settlements, audits, assessments, and contingencies; or potential material weaknesses in the future; information technology risks, including the risk of cyberattack; and other risks and uncertainties contained in our Annual Report on Form 10-K and our other filings with the U.S. Securities and Exchange Commission ("SEC"), which are available free of charge on the SEC website at www.sec.gov. The risks and uncertainties referred to above are generally beyond our ability to control and we cannot predict all the risks and uncertainties that could cause our actual results to differ from those indicated by the forward-looking statements. If any of these risks or uncertainties materialize, or if any of the underlying assumptions prove incorrect, actual results may vary from those indicated by the forward-looking statements, and such variances may be material. All subsequent written and verbal forward-looking statements made by or attributable to us or to persons acting on our behalf are expressly qualified in their entirety by reference to these risks and uncertainties. You should not place undue reliance on forward-looking statements. Each forward-looking statement speaks only as of the date of the particular statement, and we undertake no obligation to update or revise any forward-looking statements we may make, except as may be required by law.

Schedule A - Income Statement (unaudited)

Results of Operations (unaudited) | Three Months Ended | Six Months Ended | ||||||||||||||

June 30, 2019 | Mar 31, 2019 | June 30, 2018 | June 30, 2019 | June 30, 2018 | ||||||||||||

(in Thousands, Except per Unit Amounts) | ||||||||||||||||

Revenues: | ||||||||||||||||

Compression and related services | $ 64,546 | $ 63,032 | $ 56,709 | $ 127,578 | $ 110,444 | |||||||||||

Aftermarket services | 18,169 | 13,601 | 15,094 | 31,770 | 29,110 | |||||||||||

Equipment sales | 53,141 | 26,803 | 28,119 | 79,944 | 45,785 | |||||||||||

Total revenues | 135,856 | 103,436 | 99,922 | 239,292 | 185,339 | |||||||||||

Cost of revenues (excluding depreciation and amortization expense): | ||||||||||||||||

Cost of compression and related services | 30,520 | 32,621 | 30,509 | 63,141 | 61,889 | |||||||||||

Cost of aftermarket services | 15,428 | 11,250 | 12,841 | 26,678 | 23,998 | |||||||||||

Cost of equipment sales | 47,402 | 24,229 | 24,158 | 71,631 | 39,607 | |||||||||||

Total cost of revenues | 93,350 | 68,100 | 67,508 | 161,450 | 125,494 | |||||||||||

Depreciation and amortization | 19,054 | 18,532 | 17,448 | 37,586 | 34,815 | |||||||||||

Impairments and other charges | 2,311 | - | - | 2,311 | - | |||||||||||

Selling, general, and administrative expense | 10,974 | 10,665 | 10,849 | 21,639 | 19,146 | |||||||||||

Interest expense, net | 13,045 | 13,299 | 13,823 | 26,344 | 25,256 | |||||||||||

Series A Preferred fair value adjustment | 166 | 1,304 | (586) | 1,470 | 967 | |||||||||||

Other (income) expense, net | 607 | (381) | (378) | 226 | 2,826 | |||||||||||

Income (loss) before income tax provision | (3,651) | (8,083) | (8,742) | (11,734) | (23,165) | |||||||||||

Provision (benefit) for income taxes | (704) | 4,373 | 850 | 3,669 | 2,164 | |||||||||||

Net income (loss) | $ (2,947) | $ (12,456) | $ (9,592) | $ (15,403) | $ (25,329) | |||||||||||

Net income per diluted common unit | $ (0.06) | $ (0.26) | $ (0.23) | $ (0.32) | $ (0.63) | |||||||||||

Reconciliation of Non-GAAP Financial Measures

The Partnership includes in this release the non-GAAP financial measures Adjusted EBITDA, distributable cash flow, distribution coverage ratio, and free cash flow. Adjusted EBITDA is used as a supplemental financial measure by the Partnership's management to:

- assess the Partnership's ability to generate available cash sufficient to make distributions to the Partnership's unitholders and general partner;

- evaluate the financial performance of its assets without regard to financing methods, capital structure or historical cost basis;

- measure operating performance and return on capital as compared to those of our competitors; and

- determine the Partnership's ability to incur and service debt and fund capital expenditures.

The Partnership defines Adjusted EBITDA as earnings before interest, taxes, depreciation and amortization, and before certain non-cash charges and other non-recurring or unusual expenses or charges, including impairments, equity compensation, non-cash costs of compressors sold, fair value adjustments of our Preferred Units, write-off of unamortized financing costs, and excluding Series A Convertible Preferred Unit redemption premiums, and severance.

Distributable cash flow is used as a supplemental financial measure by the Partnership's management, as it provides important information relating to the relationship between our financial operating performance and our cash distribution capability. Additionally, the Partnership uses distributable cash flow in setting forward expectations and in communications with the board of directors of our general partner. The Partnership defines distributable cash flow as Adjusted EBITDA less current income tax expense, maintenance capital expenditures, interest expense, and severance expense, plus non-cash interest expense.

The Partnership believes that the distribution coverage ratio provides important information relating to the relationship between the Partnership's financial operating performance and its cash distribution capability. The Partnership defines the distribution coverage ratio as the ratio of distributable cash flow to the total quarterly distribution payable, which includes, as applicable, distributions payable on all outstanding common units, the general partner interest and the general partner's incentive distribution rights.

The Partnership defines free cash flow as net cash provided by operating activities less capital expenditures, net of sales proceeds. Management primarily uses this metric to assess our ability to retire debt, evaluate our capacity to further invest and grow, and measure our performance as compared to our peer group of companies.

These non-GAAP financial measures should not be considered an alternative to net income, operating income, cash flows from operating activities or any other measure of financial performance presented in accordance with GAAP. These non-GAAP financial measures may not be comparable to Adjusted EBITDA, gross margin, distributable cash flow, free cash flow or other similarly titled measures of other entities, as other entities may not calculate these non-GAAP financial measures in the same manner as CSI Compressco. Management compensates for the limitation of these non-GAAP financial measures as an analytical tool by reviewing the comparable GAAP measures, understanding the differences between the measures and incorporating this knowledge into management's decision-making process. Furthermore, these non-GAAP measures should not be viewed as indicative of the actual amount of cash that CSI Compressco has available for distributions or that the Partnership plans to distribute for a given period, nor should they be equated to available cash as defined in the Partnership's partnership agreement.

Schedule B - Reconciliation of Net Income/(Loss) to Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio (unaudited)

The following table reconciles net income (loss) to Adjusted EBITDA, distributable cash flow and distribution coverage ratio for the three month periods ended June 30, 2019, March 31, 2019 and June 30, 2018 and six month periods ended June 30, 2019 and June 30, 2018:

Three Months Ended | Six Months Ended | ||||||||

June 30, 2019 | Mar 31, 2019 | June 30, 2018 | June 30, 2019 | June 30, 2018 | |||||

(In Thousands) | |||||||||

Net income (loss) | $ (2,947) | $ (12,456) | $ (9,592) | $ (15,403) | $ (25,329) | ||||

Interest expense, net | 13,045 | 13,299 | 13,823 | 26,344 | 25,256 | ||||

Provision for income taxes | (704) | 4,373 | 850 | 3,669 | 2,164 | ||||

Depreciation and amortization | 19,054 | 18,532 | 17,448 | 37,586 | 34,815 | ||||

Impairments and other charges | 2,464 | - | - | 2,464 | - | ||||

Non-cash cost of compressors sold | 98 | 940 | 811 | 1,038 | 1,135 | ||||

Equity Compensation | 590 | 365 | 496 | 955 | (108) | ||||

Series A Preferred redemption premium | 621 | 448 | - | 1,069 | - | ||||

Series A Preferred fair value adjustments | 166 | 1,304 | (586) | 1,470 | 967 | ||||

Un-amortized financing cost charged to expense | - | - | - | - | 3,541 | ||||

Severance | - | - | 12 | - | 12 | ||||

Other | 376 | - | - | 376 | - | ||||

Adjusted EBITDA | $ 32,763 | $ 26,805 | $ 23,262 | $ 59,568 | $ 42,453 | ||||

Less: | |||||||||

Current income tax expense | (184) | 2,907 | 774 | 2,723 | 1,992 | ||||

Maintenance capital expenditures | 4,900 | 5,729 | 5,591 | 10,629 | 9,928 | ||||

Interest expense | 13,045 | 13,299 | 13,823 | 26,344 | 25,256 | ||||

Severance and other | 376 | - | 12 | 376 | 12 | ||||

Plus: | |||||||||

Non-cash interest expense | 1,101 | 1,428 | 2,154 | 2,529 | 4,838 | ||||

Distributable cash flow | 15,727 | 6,298 | 5,216 | 22,025 | 10,103 | ||||

Cash distribution attributable to period | 477 | 477 | 8,015 | 954 | 15,631 | ||||

Distribution coverage ratio | 32.97x | 13.2x | 0.65x | 23.09x | 0.65x | ||||

Schedule C - Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow (unaudited)

The following table reconciles net cash provided by operating activities to free cash flow for the three month periods ended June 30, 2019, March 31, 2019 and June 30, 2018 and six month periods ended June 30, 2019 and June 30, 2018:

Results of Operations (unaudited) | Three Months Ended | Six Months Ended | |||||||

June 30, 2019 | March 31, 2019 | June 30, 2018 | June 30, 2019 | June 30, 2018 | |||||

(In Thousands) | |||||||||

Cash from operations | $ 8,710 | $ 31,632 | $ (3,908) | $ 40,342 | $ (4,273) | ||||

Capital expenditures, net of sales proceeds | (16,434) | (23,152) | (30,223) | (39,586) | (47,262) | ||||

Free cash flow | $ (7,724) | $ 8,480 | $ (34,131) | $ 756 | $ (51,535) | ||||

Schedule D - Reconciliation of Projected Net Income/(Loss) to Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio (unaudited)

The following table reconciles a range of projected 2019 net income (loss) to projected 2019 Adjusted EBITDA and projected 2019 Distribution Coverage Ratio.

2019 Guidance | |||

(In Thousands) | |||

Low ($125M EBITDA) | High ($130M EBITDA) | ||

Net income (loss) | $ (15,199) | $ (13,299) | |

Interest expense, net | 52,000 | 52,500 | |

Provision for income taxes | 2,700 | 3,300 | |

Depreciation and amortization | 76,000 | 78,000 | |

Non-cash cost of compressors sold | 2,400 | 2,000 | |

Equity Compensation | 1,800 | 2,200 | |

Impairments and other charges | 2,311 | 2,311 | |

Unusual items (incl. Series A Issuance costs) | 2,988 | 2,988 | |

Adjusted EBITDA | $ 125,000 | $ 130,000 | |

Less: Current income tax expense | $ 2,700 | $ 3,300 | |

Less: Maintenance capital expenditures | 18,000 | 20,000 | |

Less: Interest Expense, net | 52,000 | 52,500 | |

Plus: Non-cash items included in interest expense | 4,000 | 6,000 | |

Distributable cash flow | $ 56,300 | $ 60,200 | |

Cash distribution attributable to period | $ 1,800 | $ 2,000 | |

Distribution coverage ratio | 31.28x | 30.10x | |

Schedule D assumes common unit distributions in 2019 will continue at the current amount of $0.04 per common unit on an annualized basis. |

SOURCE CSI Compressco LP