THE WOODLANDS, Texas, April 17, 2023 /PRNewswire/ -- CSI Compressco LP ("CSI Compressco") (NASDAQ: CCLP) announced today that the board of directors of its general partner has declared a cash distribution attributable to the quarter ended March 31, 2023 of $0.01 per outstanding common unit, or $0.04 per outstanding common unit on an annualized basis. This cash distribution will be paid on May 15, 2023 to all common unitholders of record as of the close of business on April 30, 2023.

CSI Compressco expects to release its first quarter 2023 results before the opening of the market on Thursday, May 4, 2023. Following the release, CSI Compressco will host a conference call at 10:30 a.m. Eastern Time to discuss the results. CSI Compressco invites you to listen to the conference call by calling the toll-free number 1-866-374-8397. The conference call will also be available by live audio webcast and may be accessed through CSI Compressco's website at www.csicompressco.com. The news release will be available on CSI Compressco's website prior to the conference call. An audio replay of the conference call will be available at 1-877-344-7529, conference number 10178224, replay code 4997718, for one week following the conference call and the archived webcast will be available through CSI Compressco's website for thirty days following the conference call.

About CSI Compressco

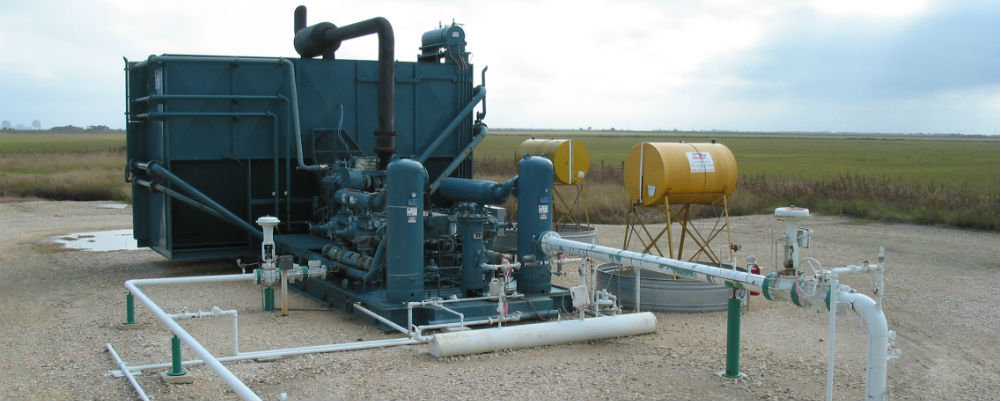

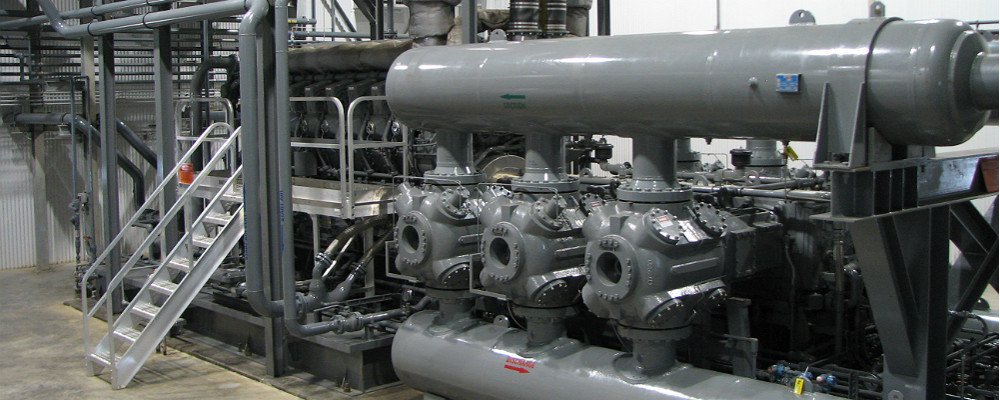

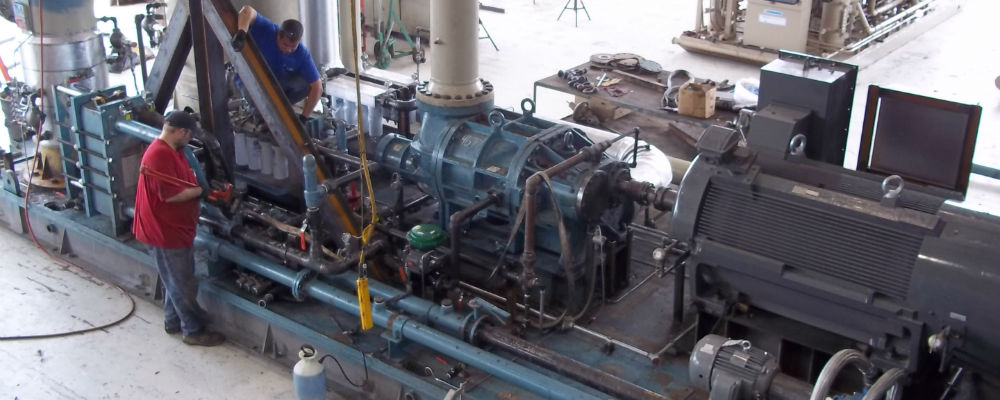

CSI Compressco is a provider of compression services and equipment for natural gas and oil production, gathering, artificial lift, transmission, processing, and storage. In addition, CSI Compressco provides a variety of natural gas treating services. CSI Compressco's contract services business includes a fleet of approximately 4,800 compressor packages providing approximately 1.2 million in aggregate horsepower, utilizing a full spectrum of low-, medium- and high-horsepower engines. Additionally, our gas treating equipment fleet includes natural gas cooling units used to reduce the temperature of natural gas so that it can be further treated, processed, or compressed. CSI Compressco also provides well monitoring and automated sand separation services in conjunction with compression and related services in Mexico. CSI Compressco's aftermarket business provides compressor package reconfiguration and maintenance services. CSI Compressco's customers comprise a broad base of natural gas and oil exploration and production, midstream, transmission, and storage companies operating throughout many of the onshore producing regions of the United States, as well as in a number of foreign countries, including Mexico, Canada, Argentina, Egypt, and Chile. CSI Compressco's General Partner is owned by Spartan Energy Partners LP. Concurrent with this announcement we are providing qualified notice to brokers and nominees that hold CSI Compressco LP units on behalf of non-US investors as provided for under Treasury Regulation Section 1.1446-4(b)(4) and (d) and Treasury Regulation Section 1.1446(f)-4(c)(2)(iii). Please note that one hundred percent (100%) of CSI Compressco LP's distributions to foreign investors are attributable to income that is effectively connected with a United States trade or business. Accordingly, all of CSI Compressco LP's distributions to foreign investors are subject to federal tax withholding at the highest applicable effective tax rate. Nominees, and not CSI Compressco LP, are treated as withholding agents responsible for withholding distributions received by them on behalf of foreign investors. For purposes of Treasury Regulation Section 1.1446(f)-4(c)(2)(iii), brokers and nominees should treat one hundred percent (100%) of the distributions as being in excess of cumulative net income for purposes of determining the amount to withhold.

SOURCE CSI Compressco LP