THE WOODLANDS, Texas, Aug. 9, 2022 /PRNewswire/ -- CSI Compressco LP ("CSI," or the "Partnership") (NASDAQ: CCLP) today announced second quarter 2022 results.

Second Quarter 2022 Results:

- Total revenues were $84.5 million compared to $76.5 million in the second quarter 2021.

- Contract services revenue increased to $64.3 million in the second quarter 2022 compared to $58.4 million in the second quarter 2021.

- Net loss was $6.8 million compared to a net loss of $9.6 million in the second quarter 2021.

- Adjusted EBITDA was $26.4 million compared to $26.5 million in the second quarter 2021.

- Compression fleet utilization increased to 82.8% compared to 76.9% in the second quarter 2021.

- Operating horsepower increased to 992,597 compared to 908,614 in the second quarter 2021.

- Distributable cash flow was $10.3 million compared to $10.1 million in the second quarter 2021.

- Distribution coverage ratio was 7.3x in the second quarter 2022 compared to 20.8x in the second quarter 2021.

- Second quarter of 2022 distribution of $0.01 per common unit will be paid on August 12, 2022.

The operating results presented throughout this document include the operating results of Spartan Treating (as defined in our 10-K filed March 14, 2022) due to the previously reported acquisition on November 10, 2021. As the Partnership and Spartan Treating were under common control at the time of Spartan's acquisition of the Partnership's general partner, the results of operations have been combined for the Partnership and Spartan Treating from the date of common control, which was January 29, 2021. As a result, operating results and certain financial metrics for the second quarter 2021 vary from what we previously reported.

Management Commentary

"During the second quarter of 2022, our revenues continued to grow. We continued deploying our idle fleet and implemented additional price increases. This increase in revenue was offset by a significant increase in costs during the quarter, largely associated with inflation and ongoing supply chain issues. The primary cost increases were from fluids (lube oil and gasoline), parts and labor. These three cost categories increased ranging from 10% to 15% quarter over quarter. These cost increases were largely offset by our improvement in utilization and as a result, our EBITDA is essentially flat quarter over quarter" commented John Jackson, Chief Executive Officer of CSI Compressco LP.

"As we look forward, it has been and continues to be difficult to predict the impact of inflation on our business and our costs. We continue to see strong demand for our products and services and have a significant amount of contracted horsepower that will be deployed in the second half of 2022. A significant portion of our compression fleet is under term contracts at any given time. As a result, we are raising prices as these units come off term and are subject to price changes. We have visibility into the balance of 2022 being very active and expect utilization to continue to improve through the remainder of 2022. We expect fleet revenue to continue to grow as the combination of price increases and utilization continues to work its way through the fleet."

"Our incremental capital expenditure focus for the near term will be to deploy our available fleet as efficiently as possible, which includes converting existing units to electric motor-drive. Lead times for key components for new build units such as engines, frames and electric drive motors continue to lengthen, therefore, capital decisions related to new build projects we make with our customers today will generally not be in place until the second quarter of 2023 or later. Our customers recognize this long lead time environment and are in discussions with us related to their 2023 needs. We have committed capital for 2023 related to first quarter projects and anticipate allocating additional capital for projects related to the balance of 2023".

"We remain upbeat about the industry as we have seen a significant rebound in activity over the last 12 months at CSI and across the entire compression industry. We look forward to the challenges and opportunities that lie ahead as we believe we have a great group of assets and people that will perform well over the coming months and years."

Net cash used in operating activities was $10.2 million in the second quarter compared to net cash used in operating activities of $5.8 million in the second quarter of 2021. Distributable cash flow in the second quarter was $10.3 million, resulting in a distribution coverage ratio of 7.3x.

This press release includes the following financial measures that are not presented in accordance with generally accepted accounting principles in the United States ("U.S. GAAP"): Adjusted EBITDA, distributable cash flow, distribution coverage ratio, free cash flow, and net leverage ratio. Please see Schedules B-E for reconciliations of these non-GAAP financial measures to the most directly comparable U.S. GAAP measures.

Unaudited results of operations for the quarter ended June 30, 2022 compared to the prior quarter and the corresponding prior year quarter are presented in the table below.

Three Months Ended | |||||||||

Jun 30, | Mar 31, | Jun 30, | Q2-2022 v | Q2-2022 v | |||||

(In Thousands, except percentage changes) | |||||||||

Net loss | $ (6,828) | $ (6,570) | $ (9,620) | (4) % | 29 % | ||||

Adjusted EBITDA | $ 26,425 | $ 26,885 | $ 26,483 | (2) % | — % | ||||

Distributable cash flow | $ 10,269 | $ 11,770 | $ 10,087 | (13) % | 2 % | ||||

Net cash provided by (used in) operating activities | $ (10,201) | $ 11,770 | $ (5,810) | — % | (76) % | ||||

Free cash flow | $ (22,031) | $ 5,835 | $ (11,390) | — % | (93) % | ||||

As of June 30, 2022, total compressor fleet horsepower was 1,198,356 and fleet horsepower in service was 992,597 for an overall fleet utilization rate of 82.8% (we define the overall service fleet utilization rate as the service compressor fleet horsepower in service divided by the total compressor fleet horsepower). Idle horsepower equipment under repair is not considered utilized, but we do count units on standby as utilized when the client is being billed a standby service rate.

Balance Sheet

Cash on hand at the end of the second quarter was $8.4 million. At the end of the second quarter, $73.6 million was outstanding on the Partnership's credit facilities. Our debt also includes $400.0 million of first lien secured bonds due in 2025 and $172.7 million of second lien secured bonds due in 2026. Net leverage ratio at the end of the quarter was 6.1x.

As of June 30, 2022, our borrowing base availability under our credit facilities was $17.9 million. Total liquidity at quarter-end was $26.3 million. In July 2022, we had significant collections from an international customer which improved our liquidity position and will positively impact our third quarter 2022 cash provided by operations. As of August 5, 2022, our borrowing base availability under our credit facilities totaled $26.8 million and total liquidity was approximately $35.0 million. This compares to total liquidity of $32.7 million at year end 2021.

Effective June 30, 2022, the termination date of our Credit Agreement was extended from June 29, 2023 to June 29, 2025. In addition, the required reserve on our Credit Agreement was reduced from $5 million to $3.5 million.

Capital Expenditures - 2022 Expectations

We expect capital expenditures for 2022 to be between $55.0 million and $65.0 million. These capital expenditures include approximately $18.0 million and $22.0 million of maintenance capital expenditures, approximately $29.0 million and $33.0 million of capital expenditures primarily associated with the expansion of our contract services fleet, and $8.0 million and $10.0 million of capital expenditures related to investments in technology, primarily software and systems.

Second Quarter 2022 Cash Distribution on Common Units

On July 19, 2022, the board of directors of our General Partner declared a cash distribution attributable to the quarter ended June 30, 2022 of $0.01 per outstanding common unit. This distribution equates to a distribution of $0.04 per outstanding common unit on an annualized basis. This distribution will be paid on August 12, 2022 to each of the holders of common units of record as of the close of business on July 29, 2022. The distribution coverage ratio for the second quarter of 2022 was 7.3x.

Conference Call

CSI will host a conference call to discuss second quarter results today, August 9, 2022, at 10:30 a.m. Eastern Time. The phone number for the call is 1-866-374-8397. The conference call will also be available by live audio webcast and may be accessed through CSI's website at www.csicompressco.com. An audio replay of the conference call will be available at 1-877-344-7529, conference number 10169664, replay code 1454494, for one week following the conference call and the archived webcast will be available through CSI's website for thirty days following the conference call.

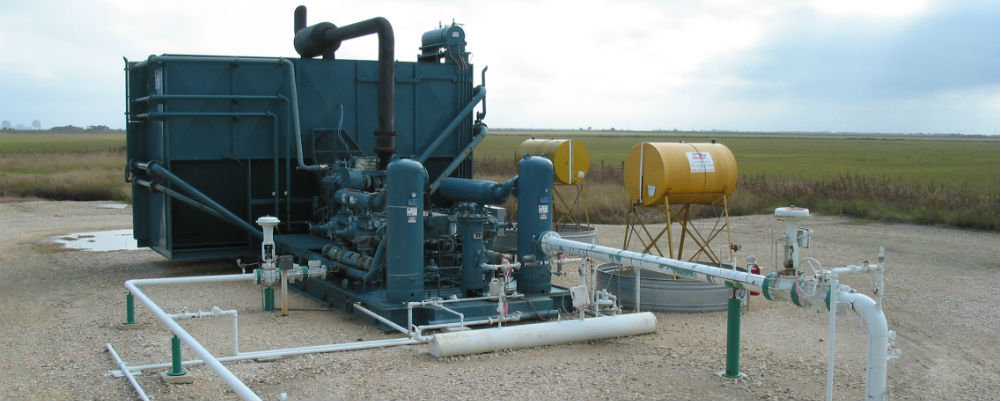

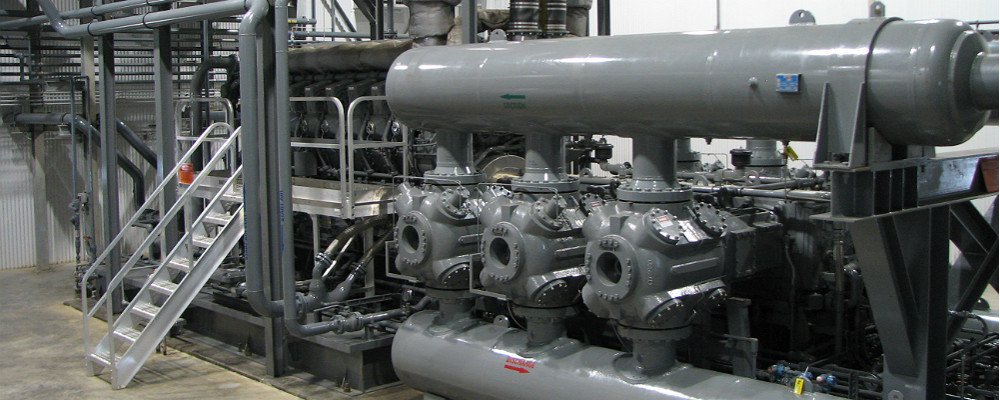

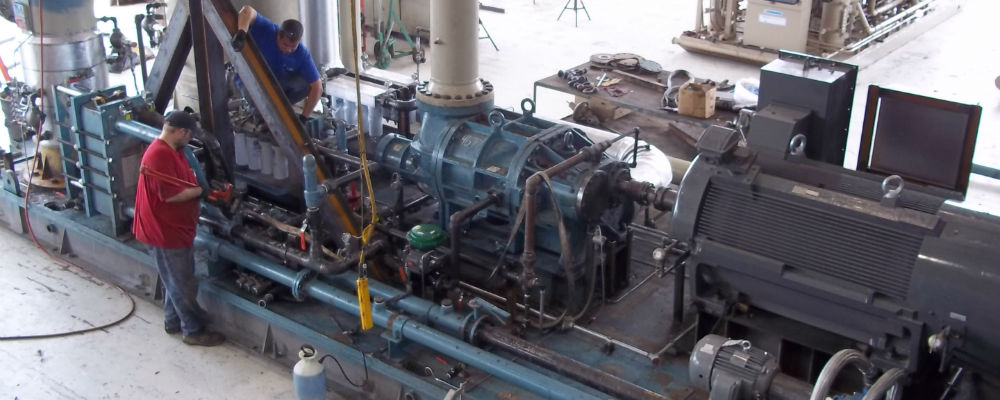

CSI Overview

CSI provides services including natural gas compression and treating services. Natural gas compression equipment is used for natural gas and oil production, gathering, artificial lift, production enhancement, transmission, processing, and storage. We also provide a variety of natural gas treating services. Our compression business includes a fleet of approximately 4,800 compressor packages providing approximately 1.2 million in aggregate horsepower, utilizing a full spectrum of low-, medium-, and high-horsepower engines. Our treating fleet includes amine units, gas coolers, and related equipment. Our aftermarket business provides compressor package overhaul, repair, engineering and design, reconfiguration and maintenance services, as well as the sale of compressor package parts and components manufactured by third-party suppliers. Our customers operate throughout many of the onshore producing regions of the United States, as well as in a number of international locations including Mexico, Canada, Argentina, Egypt and Chile. CSI's general partner is owned by Spartan Energy Partners.

Forward-Looking Statements

This news release contains "forward-looking statements" and information based on our beliefs and those of our general partner, CSI Compressco GP LLC. Forward-looking statements in this news release are identifiable by the use of the following words and other similar words: "anticipates," "assumes," "believes," "budgets," "could," "estimates," "expectations," "expects," "forecasts," "goal," "intends," "may," "might," "plans," "predicts," "projects," "schedules," "seeks," "should," "targets," "will," and "would." These forward-looking statements include statements, other than statements of historical fact, including anticipated return of standby equipment to in service, the redeployment of idle fleet compressors, joint-bidding on potential projects with Spartan, commodity prices and demand for CSI's equipment and services and other statements regarding CSI's beliefs, expectations, plans, prospects and other future events, performance, and other statements that are not purely historical. Such forward-looking statements reflect our current views with respect to future events and financial performance, and are based on assumptions that we believe to be reasonable, but such forward-looking statements are subject to numerous risks and uncertainties, including but not limited to: economic and operating condition that are outside of our control, including the trading price of our common units; the severity and duration of the COVID-19 pandemic and related economic repercussions and the resulting negative impact on the demand for oil and gas, operational challenges relating to the COVID-19 pandemic and efforts to mitigate the spread of the virus, including logistical challenges, remote work arrangements, and supply chain disruptions, other global or national health concerns; the current significant surplus in the supply of oil and the ability of OPEC and other oil producing nations to agree on and comply with supply limitations; the duration and magnitude of the unprecedented disruption in the oil and gas industry; the levels of competition we encounter; our dependence upon a limited number of customers and the activity levels of our customers; our ability to replace our contracts with our customers, which are generally short-term contracts; the availability of adequate sources of capital to us; our existing debt levels and our ability to obtain additional financing or refinancing; our ability to continue to make cash distributions, or increase cash distributions from current levels, after the establishment of reserves, payment of debt service and other contractual obligations; the restrictions on our business that are imposed under our long-term debt agreements; our operational performance; the credit and risk profile of Spartan Energy Partners; ability of our general partner to retain key personnel; risks related to acquisitions and our growth strategy; the availability of raw materials and labor at reasonable prices; risks related to our foreign operations; the effect and results of litigation, regulatory matters, settlements, audits, assessments, and contingencies; or potential material weaknesses in the future; information technology risks, including the risk of cyberattack; and other risks and uncertainties contained in our Annual Report on Form 10-K and our other filings with the U.S. Securities and Exchange Commission ("SEC"), which are available free of charge on the SEC website at www.sec.gov. The risks and uncertainties referred to above are generally beyond our ability to control and we cannot predict all the risks and uncertainties that could cause our actual results to differ from those indicated by the forward-looking statements. If any of these risks or uncertainties materialize, or if any of the underlying assumptions prove incorrect, actual results may vary from those indicated by the forward-looking statements, and such variances may be material. All subsequent written and verbal forward-looking statements made by or attributable to us or to persons acting on our behalf are expressly qualified in their entirety by reference to these risks and uncertainties. You should not place undue reliance on forward-looking statements. Each forward-looking statement speaks only as of the date of the particular statement, and we undertake no obligation to update or revise any forward-looking statements we may make, except as may be required by law.

Reconciliation of Non-GAAP Financial Measures

The Partnership includes in this release the non-GAAP financial measures Adjusted EBITDA, distributable cash flow, distribution coverage ratio, free cash flow, and net leverage ratio. Adjusted EBITDA is used as a supplemental financial measure by the Partnership's management to:

- assess the Partnership's ability to generate available cash sufficient to make distributions to the Partnership's unitholders and general partner;

- evaluate the financial performance of its assets without regard to financing methods, capital structure or historical cost basis;

- measure operating performance and return on capital as compared to those of our competitors; and

- determine the Partnership's ability to incur and service debt and fund capital expenditures.

The Partnership defines Adjusted EBITDA as earnings before interest, taxes, depreciation and amortization, and before certain charges, including impairments, bad debt expense attributable to bankruptcy of customers, equity compensation, non-cash costs of compressors sold, gain on extinguishment of debt, write-off of unamortized financing costs, and excluding, severance and other non-recurring or unusual expenses or charges.

Distributable cash flow is used as a supplemental financial measure by the Partnership's management, as it provides important information relating to the relationship between our financial operating performance and our cash distribution capability. Additionally, the Partnership uses distributable cash flow in setting forward expectations and in communications with the board of directors of our general partner. The Partnership defines distributable cash flow as Adjusted EBITDA less current income tax expense, maintenance capital expenditures, interest expense, and severance expense, plus non-cash interest expense.

The Partnership believes that the distribution coverage ratio provides important information relating to the relationship between the Partnership's financial operating performance and its cash distribution capability. The Partnership defines the distribution coverage ratio as the ratio of distributable cash flow to the total quarterly distribution payable, which includes, as applicable, distributions payable on all outstanding common units, the general partner interest and the general partner's incentive distribution rights.

The Partnership defines free cash flow as net cash provided by operating activities less capital expenditures, net of sales proceeds. Management primarily uses this metric to assess our ability to retire debt, evaluate our capacity to further invest and grow, and measure our performance as compared to our peer group of companies.

The Partnership defines net leverage ratio as net debt (the sum of the carrying value of long-term and short-term debt on its consolidated balance sheet, less cash, excluding restricted cash on the consolidated balance sheet and excluding outstanding letters of credit) divided by Adjusted EBITDA for calculating net leverage (Adjusted EBITDA as reported externally adjusted for certain items to comply with its credit agreement) for the trailing twelve-month period. Management primarily uses this metric to assess the Partnership's ability to borrow, reduce debt, add to cash balances, pay distributions, and fund investing and financing activities.

These non-GAAP financial measures should not be considered an alternative to net income, operating income, cash flows from operating activities or any other measure of financial performance presented in accordance with U.S. GAAP. These non-GAAP financial measures may not be comparable to Adjusted EBITDA, distributable cash flow, free cash flow or other similarly titled measures of other entities, as other entities may not calculate these non-GAAP financial measures in the same manner as CSI. Management compensates for the limitation of these non-GAAP financial measures as an analytical tool by reviewing the comparable U.S. GAAP measures, understanding the differences between the measures and incorporating this knowledge into management's decision-making process. Furthermore, these non-GAAP measures should not be viewed as indicative of the actual amount of cash that CSI has available for distributions or that the Partnership plans to distribute for a given period, nor should they be equated to available cash as defined in the Partnership's partnership agreement.

Schedule A - Income Statement

Results of Operations (unaudited) | |||||||||

Three Months Ended | Six Months Ended | ||||||||

Jun 30, 2022 | Mar 31, 2022 | Jun 30, 2021 | Jun 30, 2022 | Jun 30, 2021 | |||||

(In Thousands, Except per Unit Amounts) | |||||||||

Revenues: | |||||||||

Contract services | $ 64,348 | $ 62,807 | $ 58,394 | $ 127,155 | $ 114,631 | ||||

Aftermarket services | 16,213 | 12,868 | 14,918 | 29,081 | 25,952 | ||||

Equipment rentals | 3,618 | 3,500 | 3,079 | 7,118 | 5,104 | ||||

Equipment sales | 343 | 837 | 140 | 1,180 | 610 | ||||

Total revenues | $ 84,522 | $ 80,012 | $ 76,531 | $ 164,534 | $ 146,297 | ||||

Cost of revenues (excluding depreciation and amortization expense): | |||||||||

Cost of contract services | $ 33,585 | $ 31,040 | $ 28,244 | $ 64,625 | $ 55,684 | ||||

Cost of aftermarket services | 13,362 | 10,633 | 12,221 | 23,995 | 21,766 | ||||

Cost of equipment rentals | 451 | 516 | 209 | 967 | 362 | ||||

Cost of equipment sales | 165 | 452 | 29 | 617 | 346 | ||||

Total cost of revenues | $ 47,563 | $ 42,641 | $ 40,703 | $ 90,204 | $ 78,158 | ||||

Depreciation and amortization | 19,346 | 19,359 | 19,901 | 38,705 | 39,035 | ||||

Selling, general, and administrative expense | 10,911 | 10,841 | 10,502 | 21,752 | 20,803 | ||||

Interest expense, net | 12,556 | 12,381 | 13,632 | 24,937 | 27,340 | ||||

Other (income) expense, net | 325 | 544 | (226) | 869 | 69 | ||||

Loss before taxes and discontinued operations | $ (6,179) | $ (5,754) | $ (7,981) | $ (11,933) | $ (19,108) | ||||

Provision for income taxes | 741 | 816 | 1,348 | 1,557 | 3,053 | ||||

Loss from continuing operations | $ (6,920) | $ (6,570) | $ (9,329) | $ (13,490) | $ (22,161) | ||||

Loss from discontinued operations, net of taxes | $ 92 | — | (291) | 92 | (353) | ||||

Net loss | $ (6,828) | (6,570) | (9,620) | (13,398) | (22,514) | ||||

Net loss per basic and diluted common unit | $ (0.05) | $ (0.05) | $ (0.20) | $ (0.09) | $ (0.47) | ||||

Schedule B - Reconciliation of Net Loss to Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio

The following table reconciles net loss to Adjusted EBITDA, distributable cash flow and distribution coverage ratio for the three and six month periods ended June 30, 2022, March 31, 2022 and June 30, 2021:

Results of Operations (unaudited) | |||||||||

Three Months Ended | Six Months Ended | ||||||||

Jun 30, 2022 | Mar 31, 2022 | Jun 30, 2021 | Jun 30, 2022 | Jun 30, 2021 | |||||

(In Thousands, except Ratios) | |||||||||

Net loss | $ (6,828) | $ (6,570) | $ (9,620) | $ (13,398) | $ (22,514) | ||||

Interest expense, net | 12,556 | 12,381 | 13,632 | 24,937 | 27,340 | ||||

Provision for income taxes | 741 | 816 | 1,348 | 1,557 | 3,053 | ||||

Depreciation and amortization | 19,346 | 19,359 | 19,901 | 38,705 | 39,035 | ||||

Non-cash cost of compressors sold | 165 | 452 | 78 | 617 | 438 | ||||

Equity compensation | 432 | 342 | 477 | 774 | 1,310 | ||||

Prior year sales tax accrual adjustment | — | — | 367 | — | 367 | ||||

Manufacturing engine order cancellation charge | — | — | 300 | — | 300 | ||||

Severance | — | — | — | — | 114 | ||||

Provision for income taxes, depreciation, amortization and impairments attributed to discontinued operations | (92) | — | — | (92) | — | ||||

Transaction Costs | 105 | 105 | — | 210 | 308 | ||||

Adjusted EBITDA | $ 26,425 | $ 26,885 | $ 26,483 | $ 53,310 | $ 49,751 | ||||

Less: | |||||||||

Current income tax expense | 724 | 778 | 1,254 | 1,502 | 2,000 | ||||

Maintenance capital expenditures | 4,821 | 3,781 | 3,685 | 8,602 | 7,125 | ||||

Interest expense | 12,556 | 12,381 | 13,632 | 24,937 | 27,340 | ||||

Severance and other | 105 | 105 | — | 210 | 422 | ||||

Plus: | |||||||||

Non-cash items included in interest expense | 2,050 | 1,930 | 2,175 | 3,980 | 4,320 | ||||

Distributable cash flow | $ 10,269 | $ 11,770 | $ 10,087 | $ 22,039 | $ 17,184 | ||||

Cash distribution attributable to period | $ 1,412 | $ 1,412 | $ 484 | $ 2,824 | $ 968 | ||||

Distribution coverage ratio | 7.3x | 8.3x | 20.8 x | 7.8x | 17.8x | ||||

Schedule C - Reconciliation of Net Cash Provided by Operating Activities Operations to Free Cash Flow

The following table reconciles net cash provided by operating activities to free cash flow for the three and six month periods ended June 30, 2022, March 31, 2022 and June 30, 2021:

Results of Operations (unaudited) | |||||||||

Three Months Ended | Six Months Ended | ||||||||

Jun 30, 2022 | Mar 31, | Jun 30, | Jun 30, | Jun 30, | |||||

(In Thousands) | |||||||||

Net cash provided by (used in) operating activities | $ (10,201) | $ 11,770 | $ (5,810) | $ 1,569 | $ 5,734 | ||||

Capital expenditures, net of sales proceeds | (11,830) | (5,935) | (5,580) | (17,765) | (9,988) | ||||

Free cash flow | $ (22,031) | $ 5,835 | $ (11,390) | $ (16,196) | $ (4,254) | ||||

Schedule D – Reconciliation to Adjusted EBITDA Margin (unaudited)

Three Months Ended | Six Months Ended | ||||||||

Jun 30, 2022 | Mar 31, 2022 | Jun 30, 2021 | Jun 30, 2022 | Jun 30, 2021 | |||||

Consolidated | (In Thousands, except Margin %) | ||||||||

Revenue | $ 84,522 | $ 80,012 | $ 76,531 | $ 164,534 | $ 146,297 | ||||

Loss before taxes and discontinued operations | $ (6,179) | $ (5,754) | $ (7,981) | $ (11,933) | $ (19,108) | ||||

Adjusted loss margin before taxes and discontinued operations | (7.3) % | (7.2) % | (10.4) % | (7.3) % | (13.1) % | ||||

Adjusted EBITDA (Schedule B) | $ 26,425 | $ 26,885 | $ 26,483 | $ 53,310 | $ 49,751 | ||||

Adjusted EBITDA Margin | 31.3 % | 33.6 % | 34.6 % | 32.4 % | 34.0 % | ||||

Schedule E – Reconciliation of Net Loss to Adjusted EBITDA for Net Leverage Ratio Calculation (unaudited)

(in thousands, except ratios)

Twelve Months | |

Jun 30, 2022 | |

Net loss | $ (41,270) |

Interest expense, net | 52,389 |

Provision for income taxes | 3,597 |

Depreciation and amortization | 77,904 |

Non-cash cost of compressors sold | 3,546 |

Equity Compensation | 1,750 |

ERP Write off | 4,635 |

Transaction costs | 2,048 |

Reorganization cost | 754 |

Provision for income taxes, depreciation, amortization and impairments attributed to discontinued operations | 164 |

Other | (137) |

Adjusted EBITDA | $ 105,380 |

Debt Schedule | Jun 30, 2022 |

7.50% First Lien Notes | $ 400,000 |

10.00%/10.75% Second Lien Notes | 172,717 |

Asset Based Loan | 73,575 |

Finance Lease | 7,241 |

Letters of Credit | 1,889 |

Cash on Hand | (8,364) |

Net Debt | $ 647,058 |

Net Leverage Ratio (Net Debt/Adjusted EBITDA for Net Leverage Calculation) | 6.1x |

Schedule F – Balance Sheet

June 30, | December 31, | ||

(in thousands) | (Unaudited) | ||

ASSETS | |||

Current assets: | |||

Cash and cash equivalents | $ 8,364 | $ 6,598 | |

Trade accounts receivable, net of allowances for doubtful accounts of $1,274 as of June 30, 2022 and $1,223 as of December 31, 2021 | 67,206 | 53,520 | |

Trade receivable - affiliate | 3,283 | — | |

Inventories | 43,358 | 33,271 | |

Prepaid expenses and other current assets | 12,382 | 7,390 | |

Total current assets | 134,593 | 100,779 | |

Property, plant, and equipment: | |||

Land and building | 9,103 | 13,409 | |

Compressors and equipment | 1,098,878 | 1,072,927 | |

Vehicles | 8,597 | 8,469 | |

Construction in progress | 17,587 | 31,968 | |

Total property, plant, and equipment | 1,134,165 | 1,126,773 | |

Less accumulated depreciation | (584,887) | (556,311) | |

Net property, plant, and equipment | 549,278 | 570,462 | |

Other assets: | |||

Intangible assets, net of accumulated amortization of $35,150 as of June 30, 2022 and $33,672 as of December 31, 2021 | 20,617 | 22,095 | |

Operating lease right-of-use assets | 28,933 | 25,898 | |

Deferred tax asset | 5 | 5 | |

Other assets | 2,892 | 3,122 | |

Total other assets | 52,447 | 51,120 | |

Total assets | $ 736,318 | $ 722,361 | |

LIABILITIES AND PARTNERS' CAPITAL | |||

Current liabilities: | |||

Accounts payable | $ 38,250 | $ 28,958 | |

Accrued liabilities and other | 41,998 | 42,075 | |

Current liabilities associated with discontinued operations | 81 | 262 | |

Total current liabilities | 80,329 | 71,295 | |

Other liabilities: | |||

Long-term debt, net | 644,942 | 631,141 | |

Deferred tax liabilities | 893 | 819 | |

Operating lease liabilities | 19,657 | 17,648 | |

Other long-term liabilities | 5,168 | 299 | |

Total other liabilities | 670,660 | 649,907 | |

Commitments and contingencies | |||

Partners' capital: | |||

General partner interest | (1,563) | (1,486) | |

Common units (141,213,944 units issued and outstanding at June 30, 2022 and 140,386,811 units issued and outstanding at December 31, 2021) | 1,381 | 17,049 | |

Accumulated other comprehensive income (loss) | (14,489) | (14,404) | |

Total partners' capital | (14,671) | 1,159 | |

Total liabilities and partners' capital | $ 736,318 | $ 722,361 |

SOURCE CSI Compressco LP