THE WOODLANDS, Texas, Feb. 28, 2017 /PRNewswire/ -- CSI Compressco LP ("CSI Compressco" or the "Partnership") (NASDAQ: CCLP) today announced fourth quarter and full year 2016 consolidated financial results. Highlights include:

- Fourth quarter net loss of $12.1 million, including $2.1 million favorable non-cash fair market adjustment to the Series A Preferred equity

- Fourth quarter Adjusted EBITDA(1) of $21.7 million, including $2.6 million in unusual costs related to equipment sales, and a $0.7 million charge to field inventory

- Fourth quarter net cash provided from operating activities of $15.9 million

- Fourth quarter free cash flow(1) of $12.9 million

- Fourth quarter cash distribution of $0.3775 per common unit, unchanged from prior quarter

- Fourth quarter and full year 2016 distribution coverage ratios(1) of 0.68x and 0.99x, respectively

- Fourth quarter Equipment Sales orders received totaling $20.3 million

- Compression fleet utilization increased by 1.2% in fourth quarter compared to prior quarter

- Continued management of SGA expenditures

- Multiple office locations consolidated into primary business office in The Woodlands, TX

|

Three Months Ended |

Dec 31, 2016 vs. Sept 30, 2016 |

Dec 31, 2016 vs. Dec 31, 2015 | |||||||||||||||

|

Dec 31, 2016 |

Sept 30, 2016 |

Dec 31, 2015 |

|||||||||||||||

|

(In Thousands, Except Ratios, and Percentages) | |||||||||||||||||

|

Net income (loss) |

$ |

(12,138) |

$ |

(15,971) |

$ |

(151,220) |

24 % |

92 % |

|||||||||

|

Adjusted EBITDA(1) |

$ |

21,682 |

$ |

23,967 |

$ |

31,873 |

(10) % |

(32)% |

|||||||||

|

Distributable cash flow(1) |

$ |

8,798 |

$ |

12,715 |

$ |

19,378 |

(31) % |

(55)% |

|||||||||

|

Quarterly Cash distribution per unit |

$ |

0.3775 |

$ |

0.3775 |

$ |

0.3775 |

— % |

— % |

|||||||||

|

Distribution coverage ratio(1) |

0.68x |

0.99x |

1.52x |

— |

— |

||||||||||||

|

Fleet growth capital expenditures |

$ |

— |

$ |

— |

$ |

18,247 |

— % |

(100)% |

|||||||||

|

Net cash provided by operating activities |

$ |

15,922 |

$ |

9,958 |

$ |

38,351 |

60 % |

(58)% |

|||||||||

|

Free cash flow(1) |

$ |

12,865 |

$ |

6,162 |

$ |

19,077 |

109 % |

(33) % |

|||||||||

|

(1) |

Adjusted EBITDA, distributable cash flow, distribution coverage ratio, and free cash flow are non-GAAP financial measures that are reconciled to the nearest GAAP financial measure on Schedules B and C to this press release. |

Consolidated revenues for the quarter ended December 31, 2016 were $82.9 million compared to $70.7 million for the third quarter of 2016 and $99.4 million for the fourth quarter of 2015. Loss before tax for the quarter ended December 31, 2016 was $11.8 million compared to loss before tax of $15.8 million for the third quarter of 2016 and loss before tax of $152.6 million for the fourth quarter of 2015, which included a $139.4 million goodwill impairment.

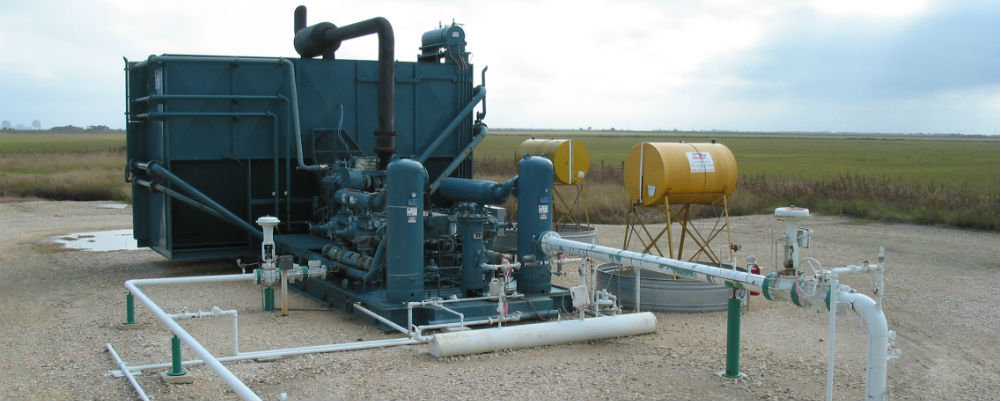

As of December 31, 2016, compression services fleet horsepower totaled 1,114,312 horsepower and the fleet utilization rate was 76.4%. We define the fleet utilization rate as the aggregate compressor package horsepower in service divided by the aggregate compressor package fleet horsepower as of a given date.

Unaudited results of operations for the three month period ended December 31, 2016 compared to the prior quarter and the prior year quarter, and unaudited results of operations for the twelve month period ended December 31, 2016 compared to the prior year period are presented in the accompanying financial tables.

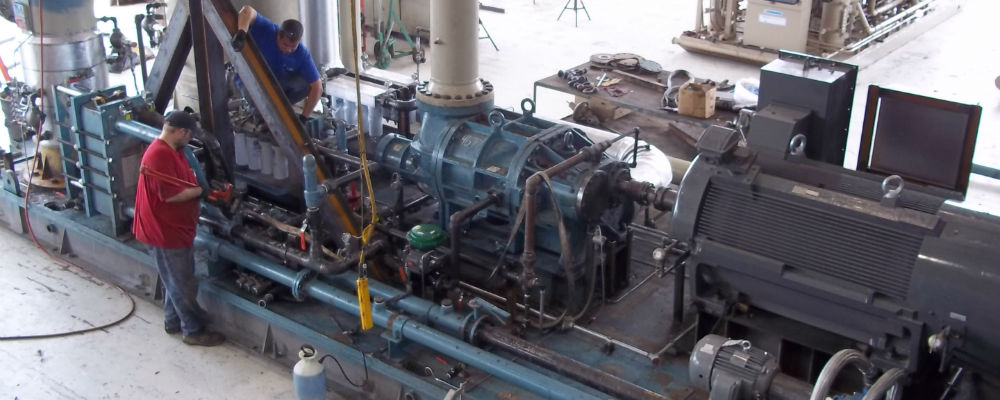

Timothy A. Knox, President of CSI Compressco, commented, "Cash flow from operations was positive in the fourth quarter of 2016 with free cash flow of $12.9 million prior to our quarterly distribution. SGA expenditures for the quarter were $8.5 million, $0.7 million lower than in the prior quarter, demonstrating effective management controls and showing signs of stabilization at this level after accounting for legal fees associated with our convertible preferred equity issuance in the third quarter of 2016. This is $2.7 million below the SGA spending level of the prior year quarter. Maintenance capital expenditures for the fourth quarter were $4.8 million, an increase from the prior quarter as necessary work was conducted. Full year gross capital expenditures for 2016 were $18.4 million, of which $11.4 million was maintenance capital, in line with our target and consistent with that of the prior year, $6.6 million was related to our ERP system development project, and $0.4 million was directed toward limited growth initiatives. Distributable cash flow for the fourth quarter of 2016 was $8.8 million, providing a 0.68x distribution coverage ratio for the $0.3775 per common unit quarterly distribution. The full year distribution coverage ratio of 0.99x occurred despite the challenging market.

"As of December, 31, 2016, 851,733 horsepower of our compression services fleet was generating revenue, with fleet utilization increased by 1.2% compared to prior quarter and the first quarterly increase in utilized horsepower since the first quarter of 2015. Fourth quarter 2016 compression services results included a $0.7 million cost to adjust field inventories. During the fourth quarter of 2016 we received equipment sales orders totaling $20.3 million, an amount of bookings comparable to the previous five quarters combined and the highest level of quarterly bookings since 2014. We believe this is an indication that the increased level of inquiries experienced the past six months is beginning to translate into project execution and spending by our customers. We carried an additional $1.3 million of existing backlog forward, entering 2017 with a total of $21.6 million in equipment sales backlog. Fourth quarter 2016 equipment sales results included $2.6 million in cost overruns on two highly customized international projects that were both brought to conclusion during the quarter. These are the first such cost overruns experienced in recent years.

"As we enter 2017 seeing what we believe are early signs of recovery throughout the oil and gas industry, we will continue with a conservative approach to capital spending, continuing our efforts to maximize the utilization of existing assets and searching for opportunities to capture appropriate financial return on new investments. Our 2017 business plan calls for $15.0 million to $30.0 million of total capital expenditures, prior to asset disposals and associated proceeds. This includes an estimated $10 million to $13 million of maintenance capital expenditures, and approximately $2.4 million in continued investment in our ERP system implementation. We will monitor the market throughout the year and may adjust our plans for growth as opportunities arise."

Conference Call

CSI Compressco will host a conference call to discuss fourth quarter and full year 2016 results today, February 28, 2017, at 10:30 a.m. Eastern Time. The phone number for the call is 866-374-8397. The conference will also be available by live audio webcast and may be accessed through the CSI Compressco website at www.csicompressco.com.

Fourth Quarter 2016 Cash Distribution on Common Units

On January 20, 2017, CSI Compressco announced that the board of directors of its general partner declared a cash distribution attributable to the fourth quarter of 2016 of $0.3775 per outstanding common unit, which was paid on February 14, 2017 to common unitholders of record as of the close of business on February 1, 2017. The distribution coverage ratio (which is a Non-GAAP Financial Measure defined and reconciled to the closest GAAP financial measure below) for the fourth quarter of 2016 was 0.68x.

CSI Compressco Overview

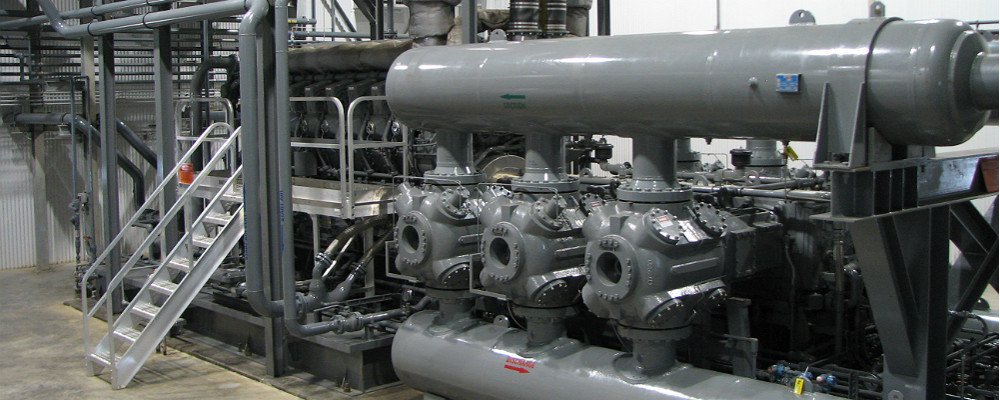

CSI Compressco is a provider of compression services and equipment for natural gas and oil production, gathering, transportation, processing, and storage. CSI Compressco's compression and related services business includes a fleet of approximately 6,000 compressor packages providing in excess of 1.1 million in aggregate horsepower, utilizing a full spectrum of low-, medium-, and high-horsepower engines. CSI Compressco also provides well monitoring and automated sand separation services in conjunction with compression services in Mexico. CSI Compressco's equipment sales business includes the fabrication and sale of standard compressor packages, custom-designed compressor packages, and oilfield fluid pump systems designed and fabricated primarily at our facility in Midland, Texas. CSI Compressco's aftermarket business provides compressor package reconfiguration and maintenance services as well as the sale of compressor package parts and components manufactured by third-party suppliers. CSI Compressco's customers comprise a broad base of natural gas and oil exploration and production, mid-stream, transmission, and storage companies operating throughout many of the onshore producing regions of the United States as well as in a number of foreign countries, including Mexico, Canada, and Argentina. CSI Compressco is managed by CSI Compressco GP Inc., which is an indirect, wholly owned subsidiary of TETRA Technologies, Inc. (NYSE: TTI).

Forward Looking Statements

This press release contains "forward-looking statements" and information based on our beliefs and those of our general partner, CSI Compressco GP Inc. Forward-looking statements in this press release are identifiable by the use of the following words and other similar words: "anticipates", "assumes", "believes", "budgets", "could", "estimates", "expects", "forecasts", "goal", "intends", "may", "might", "plans", "predicts", "projects", "schedules", "seeks", "should", "targets", "will" and "would". These forward-looking statements include statements, other than statements of historical fact, concerning the recovery of the oil and gas industry and CSI Compressco's strategy, future operations, financial position, estimated revenues, negotiations with our bank lenders, projected costs and other statements regarding CSI Compressco's beliefs, expectations, plans, prospects, and other future events and performance. Such forward-looking statements reflect our current views with respect to future events and financial performance and are based on assumptions that we believe to be reasonable but such forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to: economic and operating conditions that are outside of our control, including the supply, demand, and prices of crude oil and natural gas; the levels of competition we encounter; the activity levels of our customers; the availability of adequate sources of capital to us; our ability to comply with contractual obligations, including those under our financing arrangements; our operational performance; the loss of our management; risks related to acquisitions and our growth strategy, including our 2014 acquisition of Compressor Systems, Inc.; the availability of raw materials and labor at reasonable prices; risks related to our foreign operations; the effect and results of litigation, regulatory matters, settlements, audits, assessments, and contingencies; or potential material weaknesses in the future; information technology risks, including the risk of cyberattack; and other risks and uncertainties contained in our Annual Report on Form 10-K and our other filings with the U.S. Securities and Exchange Commission ("SEC"), which are available free of charge on the SEC website at www.sec.gov. The risks and uncertainties referred to above are generally beyond our ability to control and we cannot predict all the risks and uncertainties that could cause our actual results to differ from those indicated by the forward-looking statements. If any of these risks or uncertainties materialize, or if any of the underlying assumptions prove incorrect, actual results may vary from those indicated by the forward-looking statements, and such variances may be material. All subsequent written and oral forward-looking statements made by or attributable to us or to persons acting on our behalf are expressly qualified in their entirety by reference to these risks and uncertainties. You should not place undue reliance on forward-looking statements. Each forward-looking statement speaks only as of the date of the particular statement, and we undertake no obligation to update or revise any forward-looking statements we may make, except as may be required by law.

|

Schedule A - Income Statement | |||||||||||||||||||

|

Results of Operations (unaudited) |

|||||||||||||||||||

|

Three Months Ended |

Twelve Months Ended | ||||||||||||||||||

|

Dec 31, 2016 |

Sept 30, 2016 |

Dec 31, 2015 |

Dec 31, 2016 |

Dec 31, 2015 | |||||||||||||||

|

(In Thousands, Except per Unit Amounts) | |||||||||||||||||||

|

Revenues: |

|||||||||||||||||||

|

Compression and related services |

$ |

51,395 |

$ |

53,103 |

$ |

66,800 |

$ |

224,736 |

$ |

287,680 |

|||||||||

|

Aftermarket services |

6,900 |

8,286 |

11,906 |

33,303 |

46,921 |

||||||||||||||

|

Equipment sales |

24,573 |

9,325 |

20,657 |

53,324 |

123,040 |

||||||||||||||

|

Total revenues |

$ |

82,868 |

$ |

70,714 |

$ |

99,363 |

$ |

311,363 |

$ |

457,641 |

|||||||||

|

Cost of revenues (excluding depreciation and amortization expense): |

|||||||||||||||||||

|

Cost of compression and related services |

$ |

28,628 |

$ |

26,961 |

$ |

32,755 |

$ |

117,154 |

$ |

142,327 |

|||||||||

|

Cost of aftermarket services |

5,730 |

5,735 |

9,981 |

25,362 |

39,232 |

||||||||||||||

|

Cost of equipment sales |

24,337 |

7,830 |

17,017 |

48,744 |

109,101 |

||||||||||||||

|

Total cost of revenues |

$ |

58,695 |

$ |

40,526 |

$ |

59,753 |

$ |

191,260 |

$ |

290,660 |

|||||||||

|

Depreciation and amortization |

17,107 |

17,822 |

20,611 |

72,123 |

81,838 |

||||||||||||||

|

Impairments of long-lived assets |

2,357 |

— |

11,797 |

10,223 |

11,797 |

||||||||||||||

|

Selling, general, and administrative expense |

8,530 |

9,279 |

11,207 |

36,222 |

43,479 |

||||||||||||||

|

Goodwill impairment |

— |

— |

139,444 |

92,334 |

139,444 |

||||||||||||||

|

Interest expense, net |

10,621 |

9,762 |

8,807 |

38,055 |

34,964 |

||||||||||||||

|

Series A Preferred fair value adjustment |

(2,162) |

7,198 |

— |

5,036 |

— |

||||||||||||||

|

Other expense, net |

(510) |

1,898 |

356 |

2,383 |

2,190 |

||||||||||||||

|

Income (loss) before income tax provision |

$ |

(11,770) |

$ |

(15,771) |

$ |

(152,612) |

$ |

(136,273) |

$ |

(146,731) |

|||||||||

|

Provision (benefit) for income taxes |

368 |

200 |

(1,392) |

1,865 |

(101) |

||||||||||||||

|

Net income (loss) |

$ |

(12,138) |

$ |

(15,971) |

$ |

(151,220) |

$ |

(138,138) |

$ |

(146,630) |

|||||||||

|

Net income (loss) per basic and diluted common unit |

$ |

(0.36) |

$ |

(0.47) |

$ |

(4.47) |

$ |

(4.07) |

$ |

(4.36) |

|||||||||

Reconciliation of Non-GAAP Financial Measures

The Partnership includes in this release the non-GAAP financial measures Adjusted EBITDA, distributable cash flow, distribution coverage ratio, and free cash flow. Adjusted EBITDA is used as a supplemental financial measure by the Partnership's management to:

- assess the Partnership's ability to generate available cash sufficient to make distributions to the Partnership's unitholders and general partner;

- evaluate the financial performance of its assets without regard to financing methods, capital structure or historical cost basis;

- measure operating performance and return on capital as compared to those of our competitors;

- determine the Partnership's ability to incur and service debt and fund capital expenditures; and

- monitor the financial performance measure used in the Partnership's bank credit facility financial covenant.

The Partnership defines Adjusted EBITDA as earnings before interest, taxes, depreciation and amortization, and before certain non-cash charges consisting of impairments, bad debt expense attributable to bankruptcy of customer, non-cash costs of compressors sold, equity compensation, fair value adjustments of our Preferred Units, gain on extinguishment of debt, administrative expenses under the Omnibus Agreement paid in equity using common units and excluding acquisition and transaction costs, and severance expense.

Distributable cash flow is used as a supplemental financial measure by the Partnership's management as it provides important information relating to the relationship between our financial operating performance and our cash distribution capability. Additionally, the Partnership uses distributable cash flow in setting forward expectations and in communications with the board of directors of our general partner. The Partnership defines distributable cash flow as Adjusted EBITDA less current income tax expense, maintenance capital expenditures, interest expense, and severance expense, plus non-cash interest expense.

The Partnership believes that the distribution coverage ratio provides important information relating to the relationship between the Partnership's financial operating performance and its cash distribution capability. The Partnership defines the distribution coverage ratio as the ratio of distributable cash flow to the total quarterly distribution payable, which includes, as applicable, distributions payable on all outstanding common units, the general partner interest, and the general partner's incentive distribution rights.

The Partnership defines free cash flow as net cash provided by operating activities less capital expenditures, net of sales proceeds. Management primarily uses this metric to assess our ability to retire debt, evaluate our capacity to further invest and grow, and measure our performance as compared to our peer group of companies.

These non-GAAP financial measures should not be considered an alternative to net income, operating income, cash flows from operating activities or any other measure of financial performance presented in accordance with GAAP. These non-GAAP financial measures may not be comparable to Adjusted EBITDA, distributable cash flow, free cash flow or other similarly titled measures of other entities, as other entities may not calculate these non-GAAP financial measures in the same manner as CSI Compressco. Management compensates for the limitation of these non-GAAP financial measures as an analytical tool by reviewing the comparable GAAP measures, understanding the differences between the measures and incorporating this knowledge into management's decision making process. Furthermore, these non-GAAP measures should not be viewed as indicative of the actual amount of cash that CSI Compressco has available for distributions or that the Partnership plans to distribute for a given period, nor should they be equated to available cash as defined in the Partnership's partnership agreement.

The following table reconciles net income (loss) to Adjusted EBITDA, distributable cash flow and distribution coverage ratio for the three month periods ended December 31, 2016, September 30, 2016 and December 31, 2015, and twelve month periods ended December 31, 2016 and December 31, 2015:

|

Schedule B - Reconciliation of Net Income to Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio | |||||||||||||||||||

|

Results of Operations (unaudited) |

|||||||||||||||||||

|

Three Months Ended |

Twelve Months Ended | ||||||||||||||||||

|

Dec 31, 2016 |

Sept 30, 2016 |

Dec 31, 2015 |

Dec 31, 2016 |

Dec 31, 2015 | |||||||||||||||

|

(In Thousands) | |||||||||||||||||||

|

Net income (loss) |

$ |

(12,138) |

$ |

(15,971) |

$ |

(151,220) |

$ |

(138,138) |

$ |

(146,630) |

|||||||||

|

Interest expense, net |

10,621 |

9,762 |

8,807 |

38,055 |

34,964 |

||||||||||||||

|

Provision for income taxes |

368 |

200 |

(1,392) |

1,865 |

(101) |

||||||||||||||

|

Depreciation and amortization |

17,107 |

17,822 |

20,611 |

72,123 |

81,838 |

||||||||||||||

|

Impairments of long-lived assets |

2,357 |

— |

11,797 |

10,223 |

11,797 |

||||||||||||||

|

Goodwill impairment |

— |

— |

139,444 |

92,334 |

139,444 |

||||||||||||||

|

Bad debt expense attributable to bankruptcy of customer |

— |

728 |

— |

728 |

— |

||||||||||||||

|

Non-cash costs of compressors sold |

3,941 |

890 |

2,836 |

6,772 |

3,441 |

||||||||||||||

|

Equity compensation |

792 |

775 |

505 |

3,028 |

2,164 |

||||||||||||||

|

Series A Preferred transaction costs |

85 |

3,046 |

— |

3,131 |

— |

||||||||||||||

|

Series A Preferred fair value adjustments |

(2,162) |

7,198 |

— |

5,036 |

— |

||||||||||||||

|

Gain on extinguishment of debt |

(865) |

(540) |

— |

(1,405) |

— |

||||||||||||||

|

Omnibus expense paid in equity |

1,576 |

— |

— |

1,576 |

— |

||||||||||||||

|

CSI acquisition costs |

— |

— |

— |

— |

208 |

||||||||||||||

|

Severance |

— |

57 |

485 |

562 |

772 |

||||||||||||||

|

Adjusted EBITDA |

$ |

21,682 |

$ |

23,967 |

$ |

31,873 |

$ |

95,890 |

$ |

127,897 |

|||||||||

|

Less: |

|||||||||||||||||||

|

Current income tax expense |

608 |

258 |

471 |

1,835 |

504 |

||||||||||||||

|

Maintenance capital expenditures |

4,840 |

2,771 |

3,429 |

11,359 |

11,298 |

||||||||||||||

|

Interest expense |

10,621 |

9,762 |

8,807 |

38,055 |

34,964 |

||||||||||||||

|

Severance |

— |

57 |

485 |

562 |

772 |

||||||||||||||

|

Plus: |

|||||||||||||||||||

|

Non-cash items included in interest expense |

3,185 |

1,596 |

697 |

6,873 |

2,786 |

||||||||||||||

|

Distributable cash flow |

$ |

8,798 |

$ |

12,715 |

$ |

19,378 |

$ |

50,952 |

$ |

83,145 |

|||||||||

|

Cash distribution attributable to period |

$ |

12,870 |

$ |

12,799 |

$ |

12,784 |

$ |

51,237 |

$ |

64,535 |

|||||||||

|

Distribution coverage ratio |

0.68x |

0.99x |

1.52x |

0.99x |

1.29x |

||||||||||||||

The following table reconciles cash from operations to free cash flow for the three month periods ended December 31, 2016, September 30, 2016 and December 31, 2015, and twelve month periods ended December 31, 2016 and December 31, 2015:

|

Schedule C - Reconciliation of Net Cash Provided by Operating Activities Operations to Free Cash Flow | |||||||||||||||||||

|

Results of Operations (unaudited) |

|||||||||||||||||||

|

Three Months Ended |

Twelve Months Ended | ||||||||||||||||||

|

Dec 31, 2016 |

Sept 30, 2016 |

Dec 31, 2015 |

Dec 31, 2016 |

Dec 31, 2015 | |||||||||||||||

|

(In Thousands) | |||||||||||||||||||

|

Net cash provided by operating activities |

$ |

15,922 |

$ |

9,958 |

$ |

38,351 |

$ |

61,444 |

$ |

101,893 |

|||||||||

|

Capital expenditures, net of sales proceeds |

(3,057) |

(3,796) |

(19,274) |

(10,659) |

(95,272) |

||||||||||||||

|

Free cash flow |

$ |

12,865 |

$ |

6,162 |

$ |

19,077 |

$ |

50,785 |

$ |

6,621 |

|||||||||

SOURCE CSI Compressco LP