OKLAHOMA CITY, July 24, 2014 /PRNewswire/ -- Compressco Partners, L.P. (Compressco or the Partnership) (NASDAQ: GSJK) announced today the pricing of an underwritten public offering of 15,280,000 common units representing limited partner interests in the Partnership (the "Common Units Offering"), at a public offering price of $23.50 per unit. The underwriters of the Common Units Offering have been granted an option to purchase up to an additional 2,292,000 common units within 30 days at the public offering price, less the underwriting discount. The Common Units Offering is scheduled to close on July 30, 2014, subject to customary closing conditions.

Compressco Partners expects to use the net proceeds from the Common Units Offering to fund a portion of the purchase price and related expenses of its pending acquisition of Compressor Systems, Inc. (the "Acquisition") and the repayment of borrowings under its existing revolving credit agreement. The closing of the Acquisition is not a condition to the closing of the Common Units Offering.

BofA Merrill Lynch, Barclays Capital Inc., Wells Fargo Securities, J.P. Morgan, Raymond James & Associates, Inc., Credit Suisse Securities (USA) LLC and RBC Capital Markets, LLC are acting as joint book-running managers for the underwriters in the Common Units Offering. The common units will be offered and sold pursuant to an effective shelf registration statement (including a base prospectus) on Form S-3 previously filed with the Securities and Exchange Commission under the Securities Act. Copies of the prospectus supplement and the base prospectus for the Common Units Offering may be obtained from:

|

BofA Merrill Lynch Attn: Prospectus Department 222 Broadway, New York, New York 10038 Email: dg.prospectus_requests@baml.com

|

Barclays, c/o Broadridge Financial Solutions Attn: Prospectus Department 1155 Long Island Avenue, Edgewood, New York 11717 Telephone: (888) 603-5847 Email: Barclaysprospectus@broadridge.com

|

|

Wells Fargo Securities Attn: Equity Syndicate Department 375 Park Avenue, New York, New York 10152 Telephone: (800) 326-5897 Email: cmclientsupport@wellsfargo.com

|

J.P. Morgan, c/o Broadridge Financial Solutions Attn: Prospectus Department 1155 Long Island Avenue, Edgewood, New York 11717 Telephone: (866) 803-9204

|

|

Raymond James Attn: Equity Syndicate 880 Carillon Parkway, St. Petersburg, FL 33716 Telephone: (800) 248-8863 Email: prospectus@raymondjames.com

|

Credit Suisse Attn: Prospectus Department Eleven Madison Avenue, New York, New York 10010 Telephone: (800) 221-1037 Email: newyork.prospectus@credit-suisse.com

|

|

RBC Capital Markets Attn: Equity Syndicate Three World Financial Center 200 Vesey Street, 8th Floor, New York, New York 10281 Telephone: (877) 822-4089

| |

You may also obtain these documents for free when they are available by visiting the SEC's web site at www.sec.gov.

This press release does not constitute an offer to sell or a solicitation of an offer to purchase the common units or any other securities, and does not constitute an offer, solicitation or sale in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful.

About Compressco Partners, L.P.

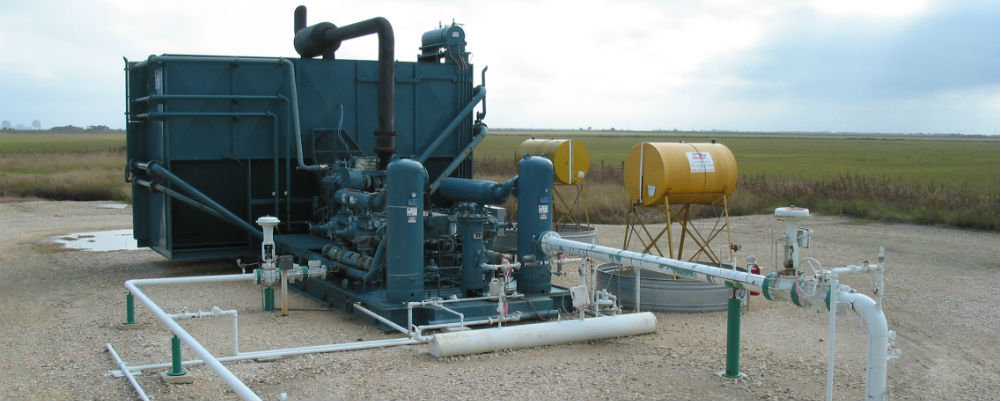

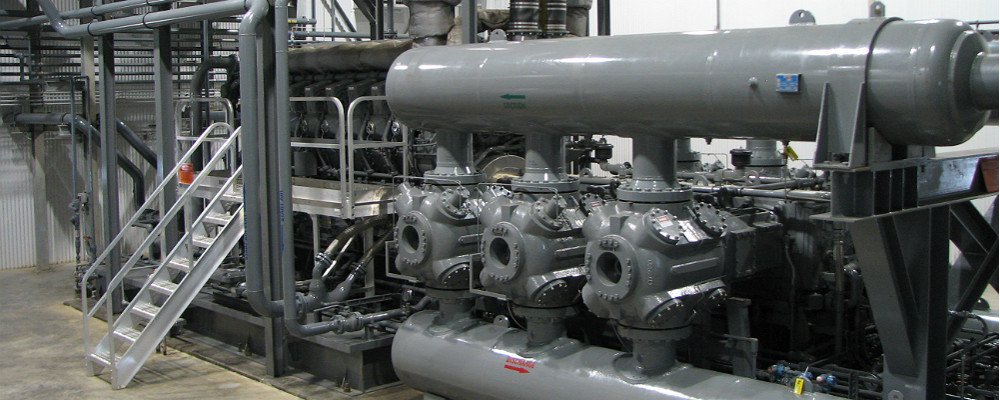

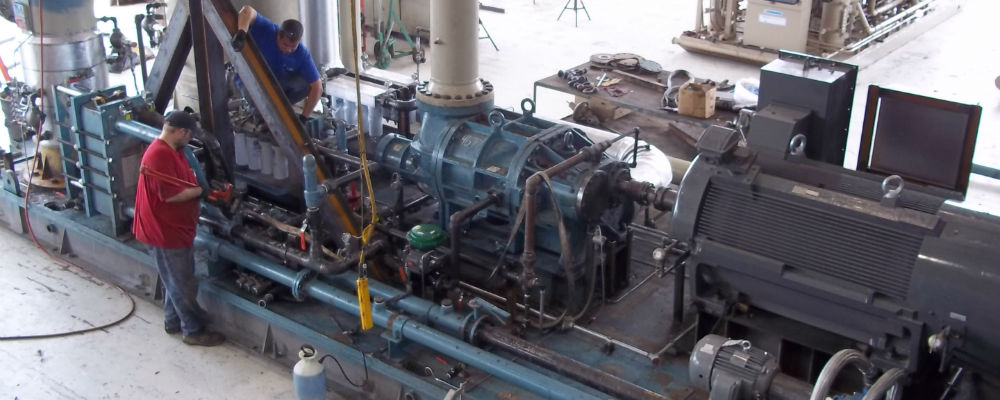

Compressco Partners is a provider of compression-based production enhancement services, which are used in both conventional wellhead compression applications and unconventional compression applications, and in certain circumstances, well monitoring and sand separation services. Compressco Partners provides services to a broad base of natural gas and oil exploration and production companies operating throughout many of the onshore producing regions of the United States. Internationally, Compressco Partners has significant operations in Mexico and Canada and a growing presence in certain countries in South America, Europe and the Asia-Pacific region. Compressco Partners is managed by Compressco Partners GP Inc., which is an indirect, wholly owned subsidiary of TETRA Technologies, Inc. (NYSE: TTI).

Forward-Looking Statements

This press release includes certain statements that are deemed to be forward-looking statements. Generally, the use of words such as "may," "expect," "intend," "estimate," "projects," "anticipate," "believe," "assume," "could," "should," "plans," "targets," or similar expressions that convey the uncertainty of future events, activities, expectations, or outcomes identify forward-looking statements. These forward-looking statements are based on certain assumptions and analyses made by Compressco Partners in light of its experience and its perception of historical trends, current conditions, expected future developments, and other factors it believes are appropriate in the circumstances. Such statements are subject to a number of risks and uncertainties, many of which are beyond the control of Compressco Partners. Investors are cautioned that any such statements are not guarantees of future performances or results and that actual results or developments may differ materially from those projected in the forward-looking statements. Some of the factors that could affect actual results are described in Compressco Partners' Annual Report on Form 10-K for the year ended December 31, 2013, as well as other risks identified from time to time in its reports on Form 10-Q and Form 8-K filed with the U.S. Securities and Exchange Commission. Compressco Partners undertakes no obligation to update or revise any forward-looking statement to reflect new information or events.

Logo - http://photos.prnewswire.com/prnh/20110614/MM19989LOGO

SOURCE Compressco Partners, L.P.