OKLAHOMA CITY, Okla., July 20, 2014 /PRNewswire/ -- Compressco Partners, L.P. (Compressco or the Partnership) (NASDAQ: GSJK) announced today that it has commenced a private offering, with its wholly owned subsidiary Compressco Finance Corp., of $350 million in aggregate principal amount of senior notes due 2022 (the "Notes Offering"). The Notes Offering is subject to market conditions, and there can be no assurance as to whether the Notes Offering will be completed or as to the actual size or terms of the Notes Offering.

Compressco Partners expects to use the net proceeds from the Notes Offering to fund a portion of the purchase price and related expenses of its pending acquisition of Compressor Systems, Inc. (the "Acquisition") and the repayment of borrowings under its existing revolving credit agreement, if any. The closing of the Notes Offering is contingent upon (i) the substantially simultaneous closing of the Acquisition, (ii) the prior or substantially simultaneous funding of the remaining sources of proceeds for the Acquisition, (iii) the repayment of borrowings under its existing revolving credit agreement and related expenses.

Under the Notes Offering, the notes will be offered and sold to qualified institutional buyers in the United States pursuant to Rule 144A under the Securities Act of 1933, as amended (the "Securities Act"), and to persons, other than U.S. persons, outside of the United States pursuant to Regulation S under the Securities Act. The offer and sale of the notes have not been registered under the Securities Act or any state securities laws and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act and applicable state laws.

This press release does not constitute an offer to sell or a solicitation of an offer to purchase the notes or any other securities, and does not constitute an offer, solicitation or sale in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful.

About Compressco Partners, L.P.

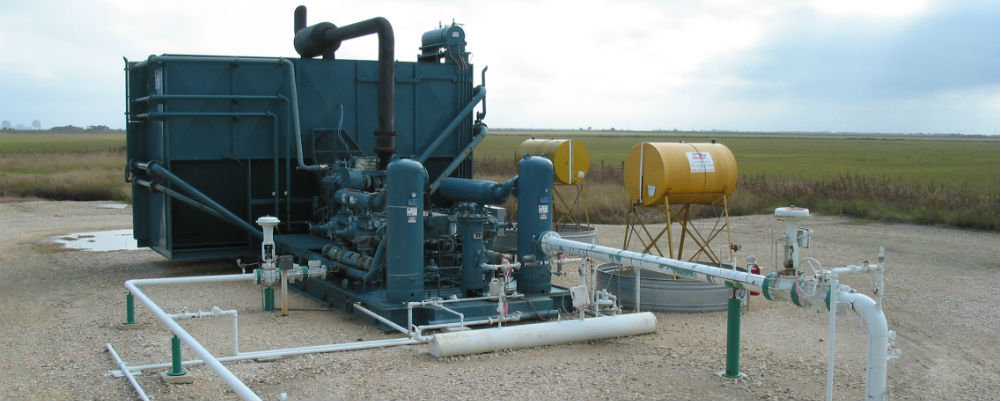

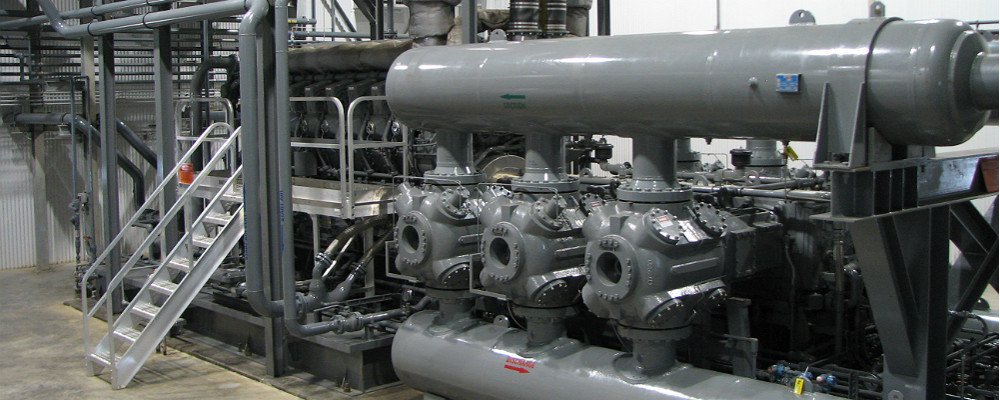

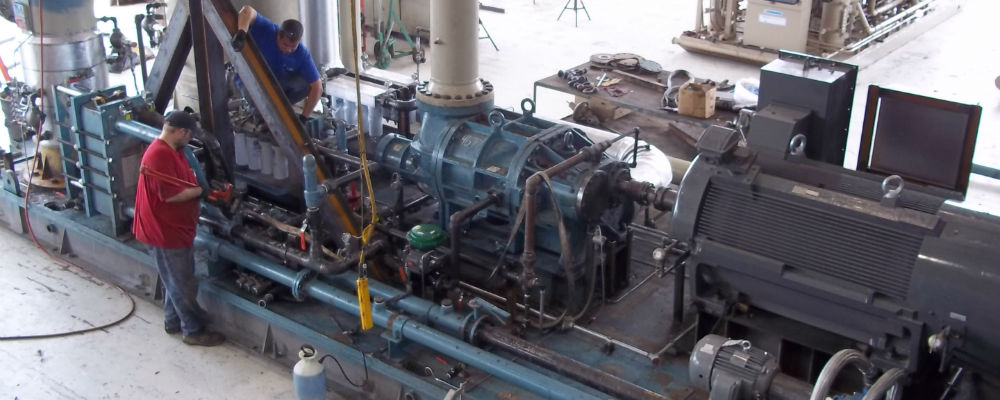

Compressco Partners is a provider of compression-based production enhancement services, which are used in both conventional wellhead compression applications and unconventional compression applications, and in certain circumstances, well monitoring and sand separation services. Compressco Partners provides services to a broad base of natural gas and oil exploration and production companies operating throughout many of the onshore producing regions of the United States. Internationally, Compressco Partners has significant operations in Mexico and Canada and a growing presence in certain countries in South America, Europe and the Asia-Pacific region. Compressco Partners is managed by Compressco Partners GP Inc., which is an indirect, wholly owned subsidiary of TETRA Technologies, Inc. (NYSE: TTI).

Forward-Looking Statements

This press release includes certain statements that are deemed to be forward-looking statements. Generally, the use of words such as "may," "expect," "intend," "estimate," "projects," "anticipate," "believe," "assume," "could," "should," "plans," "targets," or similar expressions that convey the uncertainty of future events, activities, expectations, or outcomes identify forward-looking statements. These forward-looking statements include statements concerning expected results of operations for 2014, anticipated activities by our customers, financial guidance, estimated distributable cash, estimated earnings, earnings per unit, and statements regarding Compressco Partners' beliefs, expectations, plans, goals, future events, and performance, and other statements that are not purely historical. These forward-looking statements are based on certain assumptions and analyses made by Compressco Partners in light of its experience and its perception of historical trends, current conditions, expected future developments, and other factors it believes are appropriate in the circumstances. Such statements are subject to a number of risks and uncertainties, many of which are beyond the control of Compressco Partners. Investors are cautioned that any such statements are not guarantees of future performances or results and that actual results or developments may differ materially from those projected in the forward-looking statements. Some of the factors that could affect actual results are described in Compressco Partners' Annual Report on Form 10-K for the year ended December 31, 2013, as well as other risks identified from time to time in its reports on Form 10-Q and Form 8-K filed with the U.S. Securities and Exchange Commission. Compressco Partners undertakes no obligation to update or revise any forward-looking statement to reflect new information or events.

Logo - http://photos.prnewswire.com/prnh/20110614/MM19989LOGO

SOURCE Compressco Partners, L.P.