OKLAHOMA CITY, May 7, 2013 /PRNewswire/ -- Compressco Partners, L.P. (Compressco Partners or the Partnership) (NASDAQ: GSJK) today announced first quarter 2013 consolidated results. Earnings before interest, taxes, depreciation and amortization (EBITDA) for the first quarter of 2013 were $8.8 million, with net income of $4.5 million. This compares to EBITDA and net income of $6.3 million and $2.8 million, respectively, during the prior year period. Distributable cash flow for the quarter ended March 31, 2013 was $8.0 million (EBITDA and distributable cash flow are non-GAAP financial measures that are defined and reconciled to the nearest GAAP financial measures later in the release).

(Logo: http://photos.prnewswire.com/prnh/20110614/MM19989LOGO)

Highlights of the first quarter 2013 results include:

- compression and other services revenue increased 39% over the comparable period in 2012 primarily due to strong international growth;

- EBITDA for the quarter ended March 2013 improved 39% over the first quarter of 2012;

- the number of compressor units in service increased 9.1% over the comparable 2012 period; and

- customer budget reevaluations in Mexico beginning in March 2013 resulting in decreasing revenue levels in the region.

Consolidated results reported below are for the three months ended March 31, 2013.

Consolidated revenues for the quarter ended March 31, 2013 were $30.8 million versus $22.5 million in the first quarter of 2012. Income before tax for the quarter ended March 31, 2013 was $5.3 million versus $3.3 million in the first quarter of 2012. Results of operations for the first quarter of 2013 reflect a year-over-year improvement of compressor and other service revenues, primarily in international markets, particularly driven by activity in Mexico. Compared to the first quarter of 2012, sales of compressor units and parts decreased slightly.

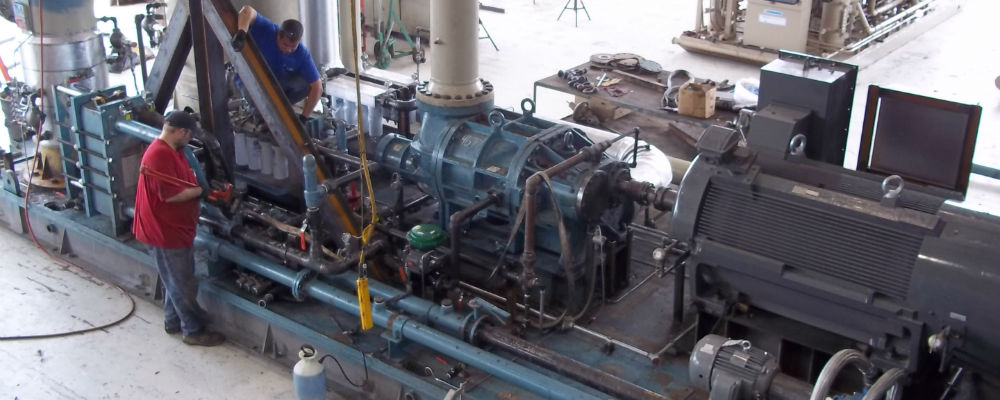

The number of compressor units providing services increased 9.1% as the Partnership utilized an average of 3,174 compressor units to provide services during the three months ended March 31, 2013, compared to an average of 2,909 compressor units utilized during the three months ended March 31, 2012. Cost of compression and other services as a percentage of compression and other services revenue increased 4.1% during the first quarter of 2013 compared to the first quarter of 2012. Higher compensation-related expenses include labor cost increases. The Partnership's administrative expenses increased slightly over the prior year period as increases in administrative salary and personnel-related expenses were offset by decreases in bad debt and other administrative expenses. At March 31, 2013, the Partnership had cash of $9.4 million and an outstanding long-term debt balance of $14.3 million.

Unaudited financial data for the three month period ended March 31, 2013 compared to the prior year's period is available in the accompanying financial tables.

Ronald J. Foster, President of Compressco Partners, remarked, "Following a strong 2012, during the first quarter of 2013 we continued our expansion throughout the markets we have targeted , including domestic conventional and unconventional applications, particularly liquids-rich shale plays, and international markets. We have focused our capital spending on US fleet growth in liquid and vapor recovery applications. Overall, we are benefitting from improved US and Canadian natural gas prices that are driving greater utilization of our fleet; the average number of compressors in service is 9.1% higher than the prior year period.

"We are enjoying year-over-year service revenue growth of $8.3 million, or 39%. The investments made in Latin America during 2012 generated a positive first quarter contribution to our revenue. However, we exited the quarter with a lower March revenue run-rate in Mexico due to budget re-evaluations by our major customer, and have seen this trend continue into April. In the meantime, we have taken appropriate cost reductions to address the lower than anticipated demand in Mexico."

Compressco Partners will host a conference call to discuss first quarter 2013 results today, May 7, 2013, at 10:30 am ET. The phone number for the call is 800/860-2442. The conference will also be available by live audio webcast and may be accessed through Compressco Partners' website at www.compressco.com.

On April 19, 2013, Compressco Partners announced that the board of directors of its general partner declared an increased cash distribution attributable to the first quarter of 2013 of $0.425 per outstanding unit, to be paid on May 15, 2013 to unit holders of record as of the close of business on May 1, 2013.

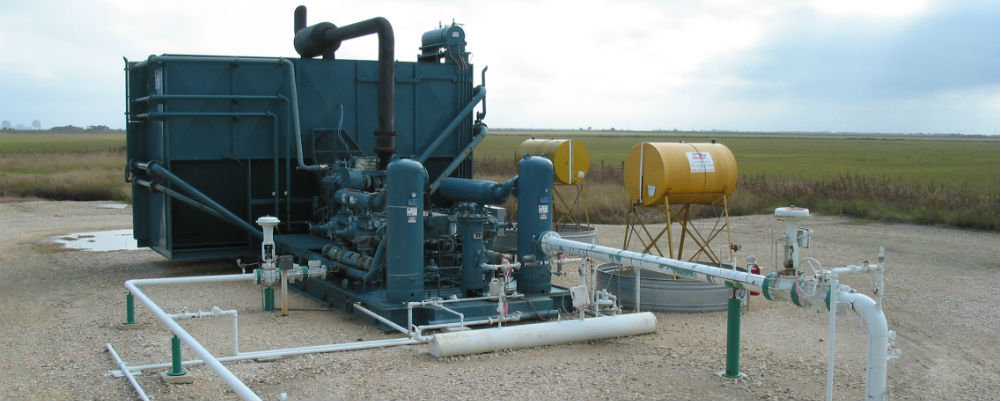

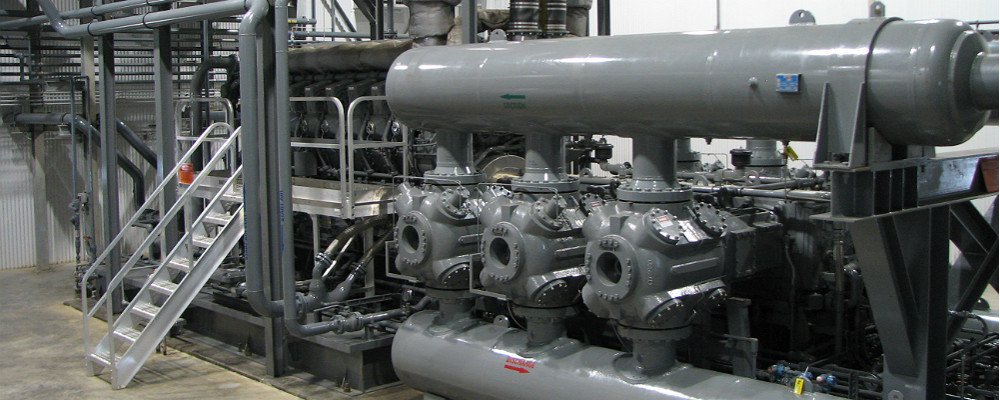

Compressco Partners is a provider of compression-based production enhancement services, which are used in both conventional wellhead compression applications and unconventional compression applications, and in certain circumstances, well monitoring and sand separation services. Compressco Partners provides services to a broad base of natural gas and oil exploration and production companies operating throughout many of the onshore producing regions of the United States. Internationally, Compressco Partners has significant operations in Mexico and Canada and a growing presence in certain countries in South America, Eastern Europe, and the Asia-Pacific region. Compressco Partners is managed by Compressco Partners GP Inc., which is an indirect, wholly owned subsidiary of TETRA Technologies, Inc. (NYSE: TTI).

Forward Looking Statements

This press release includes certain statements that are deemed to be forward-looking statements. Generally, the use of words such as "may," "will," "expect," "intend," "estimate," "projects," "anticipate," "believe," "assume," "could," "should," "plans," "targets" or similar expressions that convey the uncertainty of future events, activities, expectations or outcomes identify forward-looking statements. These forward-looking statements include statements concerning expected results of operations for 2013, anticipated activities by our customers, financial guidance, estimated distributable cash, estimated earnings, earnings per unit, and statements regarding Compressco Partners' beliefs, expectations, plans, goals, future events and performance, and other statements that are not purely historical. These forward-looking statements are based on certain assumptions and analyses made by Compressco Partners in light of its experience and its perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances. Such statements are subject to a number of risks and uncertainties, many of which are beyond the control of Compressco Partners. Investors are cautioned that any such statements are not guarantees of future performances or results and that actual results or developments may differ materially from those projected in the forward-looking statements. Some of the factors that could affect actual results are described in Compressco Partners' Annual Report on Form 10-K for the year ended December 31, 2012, as well as other risks identified from time to time in its reports on Form 10-Q and Form 8-K filed with the U.S. Securities and Exchange Commission. Compressco Partners undertakes no obligation to update or revise any forward-looking statement to reflect new information or events.

|

Financial Data (unaudited) |

Three Months Ended | ||||||

|

March 31, 2013 |

March 31, 2012 | ||||||

|

(In Thousands) | |||||||

|

Revenues |

|||||||

|

Compression and other services |

$ |

29,679 |

$ |

21,369 |

|||

|

Sales of compressors and parts |

1,088 |

1,162 |

|||||

|

Total revenues |

30,767 |

22,531 |

|||||

|

Cost of revenues (excluding depreciation and amortization expense) |

|||||||

|

Cost of compression and other services |

16,769 |

11,191 |

|||||

|

Cost of compressors and parts sales |

617 |

608 |

|||||

|

Total cost of revenues |

17,386 |

11,799 |

|||||

|

Selling, general and administrative expense |

4,606 |

4,589 |

|||||

|

Depreciation and amortization |

3,473 |

3,089 |

|||||

|

Interest (income) expense, net |

58 |

(12) |

|||||

|

Other (income) expense, net |

(17) |

(190) |

|||||

|

Income before tax provision |

5,261 |

3,256 |

|||||

|

Provision for income taxes |

722 |

489 |

|||||

|

Net income |

$ |

4,539 |

$ |

2,767 |

|||

Reconciliation of Non-GAAP Financial Measures

Compressco Partners includes in this release the non-GAAP financial measures EBITDA and distributable cash flow. EBITDA is used as a supplemental financial measure by the Partnership's management to:

- assess the Partnership's ability to generate available cash sufficient to make distributions to the Partnership's unitholders and general partner;

- evaluate the financial performance of its assets without regard to financing methods, capital structure or historical cost basis;

- measure operating performance and return on capital as compared to those of our competitors; and

- determine the Partnership's ability to incur and service debt and fund capital expenditures.

The Partnership defines EBITDA as earnings before interest, taxes, depreciation and amortization.

Distributable cash flow is used as a supplemental financial measure by the Partnership's management as it provides important information relating to the relationship between our financial operating performance and our cash distribution capability. Additionally, the Partnership uses distributable cash flow in setting forward expectations and in communications with the board of directors of our general partner. The Partnership defines distributable cash flow as EBITDA less current income tax expense, maintenance capital expenditures, and interest expense, plus the non-cash cost of compressors sold and equity compensation expense.

These non-GAAP financial measures should not be considered an alternative to net income, operating income, cash flows from operating activities or any other measure of financial performance presented in accordance with GAAP. These non-GAAP financial measures may not be comparable to EBITDA, distributable cash flow or other similarly titled measures of other entities, as other entities may not calculate these non-GAAP financial measures in the same manner as Compressco Partners. Management compensates for the limitation of these non-GAAP financial measures as an analytical tool by reviewing the comparable GAAP measures, understanding the differences between the measures and incorporating this knowledge into management's decision making process. Furthermore, these non-GAAP measures should not be viewed as indicative of the actual amount of cash that Compressco Partners has available for distributions or that the Partnership plans to distribute for a given period, nor should they be equated to available cash as defined in the Partnership's partnership agreement.

The following table reconciles net income to EBITDA for the three month periods ended March 31, 2013 and March 31, 2012:

|

Three Months Ended | |||||||

|

March 31, 2013 |

March 31, 2012 | ||||||

|

(In Thousands) | |||||||

|

Net income |

$ |

4,539 |

$ |

2,767 |

|||

|

Provision for income taxes |

722 |

489 |

|||||

|

Depreciation and amortization |

3,473 |

3,089 |

|||||

|

Interest (income) expense, net |

58 |

(12) |

|||||

|

EBITDA |

$ |

8,792 |

$ |

6,333 |

|||

The following table reconciles net income to distributable cash flow and distribution coverage ratio for the three month period ended March 31, 2013:

|

Three Months Ended | ||

|

March 31, 2013 | ||

|

(In Thousands) | ||

|

Net income |

$ |

4,539 |

|

Provision for income taxes |

722 | |

|

Depreciation and amortization |

3,473 | |

|

Interest (income) expense |

58 | |

|

EBITDA |

8,792 | |

|

Less: |

||

|

Current income tax benefit (expense) |

(894) | |

|

Maintenance capital expenditures |

(165) | |

|

Interest expense |

(58) | |

|

Plus: |

||

|

Non-cash cost of compressors sold |

42 | |

|

Equity compensation |

322 | |

|

Distributable cash flow |

$ |

8,039 |

|

Cash distribution attributable to period |

$ |

6,739 |

|

Distribution coverage ratio |

1.19x | |

SOURCE Compressco Partners, L.P.