OKLAHOMA CITY, Aug. 4, 2011 /PRNewswire/ -- Compressco Partners, L.P. (Compressco Partners or the Partnership) (NASDAQ: GSJK) today announced second quarter consolidated results from operations. Earnings before interest, taxes, depreciation and amortization (EBITDA) for the second quarter of 2011 were approximately $6,264,000, with net income of approximately $553,000. This compares to EBITDA and net income of approximately $7,590,000 and approximately $618,000 respectively, during the prior year period. Distributable cash flow for the period following the completion of the Partnership's initial public offering until the end of the second quarter was approximately $920,000 or $0.0596 per unit (EBITDA and distributable cash flow are non-GAAP financial measures that are defined and reconciled to the nearest GAAP financial measure later in this release).

(Logo: http://photos.prnewswire.com/prnh/20110614/MM19989LOGO)

On June 20, 2011, Compressco Partners successfully completed its initial public offering of 2,670,000 common units. On July 21, 2011 Compressco Partners announced that the board of directors of its general partner declared a cash distribution attributable to the period from June 20, 2011 through June 30, 2011 of $0.047 per unit, payable to unitholders of record as of the close of business on August 1, 2011. This distribution is based on the actual results during the portion of the quarter after June 20, 2011 and equates to a distribution of $0.3875 per unit for a complete quarter.

Consolidated results reported below are for the full three and six month periods ended June 30, 2011 and include the results of the Partnership's predecessor entity for the period prior to the June 20, 2011 closing date of the Partnership's initial public offering. Substantially all of the assets and operations of the Partnership's predecessor, including Compressco, Inc. and its subsidiaries and certain assets, liabilities and operations of certain other subsidiaries of TETRA Technologies, Inc. ("TETRA") conducting business in Mexico, were contributed to the Partnership in connection with the closing of the Partnership's initial public offering.

Consolidated revenues for the quarter ended June 30, 2011 were approximately $22.3 million versus approximately $20.1 million in second quarter 2010. Income before tax for the quarter ended June 30, 2011 was approximately $685,000 versus approximately $1,070,000 in the second quarter of 2010.

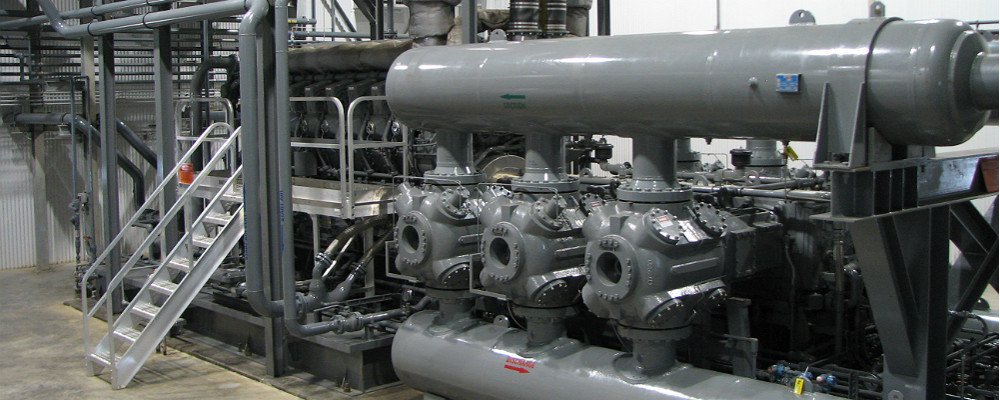

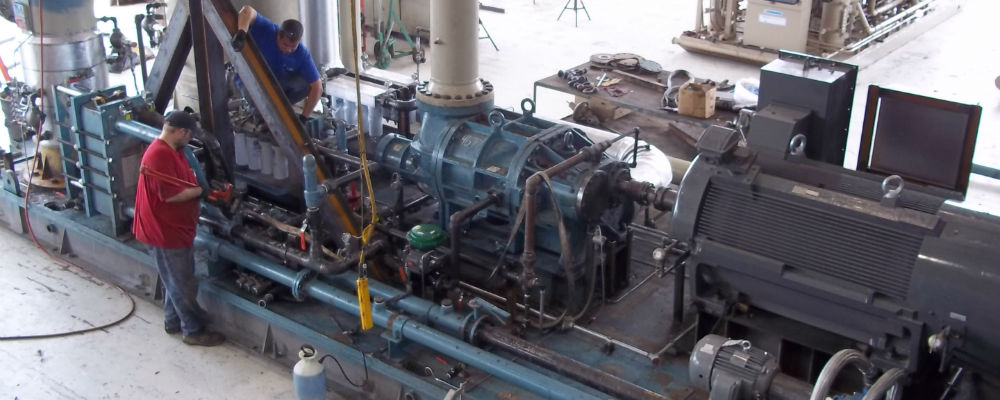

Results of operations for the second quarter of 2011 reflect the increased sales of compressor units, primarily to a single customer, resulting in increased revenues compared to the prior year period. The number of compressor units providing services on customer sites increased from 2,731 as of June 30, 2010 to 2,808 as of the end of the current period. The fleet utilization rate increased to 76.2% for the second quarter as compared to 75.4% for the prior year period. Despite the increase in fleet utilization, profitability during the second quarter of 2011 was negatively impacted, primarily by increased domestic operating expenses, particularly fuel, maintenance and labor costs.

Second quarter 2011 results also include approximately $2.4 million of interest expense associated with a revolving credit promissory note that was payable by the Partnership's predecessor to an affiliate of TETRA. As part of the Partnership's initial public offering, TETRA made a capital contribution to the Partnership's predecessor sufficient for it to repay all indebtedness owing on the note other than $32.2 million of the principal balance. This remaining balance was then repaid from the proceeds of the offering. At June 30, 2011, Compressco Partners had approximately $19.3 million of cash.

Unaudited financial data aggregating the first six months of 2011, and financial data relating to net income is available in the accompanying financial tables.

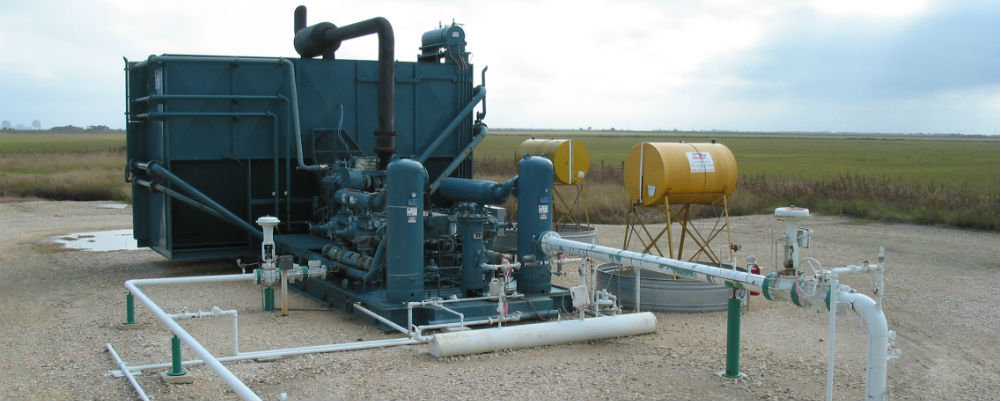

Ronald J. Foster, President of Compressco Partners, stated, "We are very pleased to have completed the IPO and look forward to continued growth. We saw a net increase in the number of compressor units in service in the past six months that is consistent with our marketing strategies. These strategies focus on new applications for uplifts in oil production, vapor recovery and electrically driven production enhancement services in addition to our core markets utilizing the GasJack® and V-Jack™ units. We continue to address the challenges of increased operating costs and expect to see positive results from our efforts in the coming quarters."

Compressco Partners is a provider of wellhead compression-based production enhancement services to a broad base of natural gas and oil exploration and production companies operating throughout most of the onshore producing regions of the United States, and has significant operations in Canada and Mexico and a growing presence in certain countries in South America, Eastern Europe and the Asia-Pacific region. Compressco Partners is managed by Compressco Partners GP Inc., which is an indirect, wholly owned subsidiary of TETRA.

Forward Looking Statements

This press release includes certain statements that are deemed to be forward-looking statements. Generally, the use of words such as "may," "will," "expect," "intend," "estimate," "projects," "anticipate," "believe," "assume," "could," "should," "plans," "targets" or similar expressions that convey the uncertainty of future events, activities, expectations or outcomes identify forward-looking statements that Compressco Partners intends to be included within the safe harbor protections provided by the federal securities laws. These forward-looking statements include statements concerning expected results of operations for 2011, financial guidance, estimated distributable cash, estimated earnings, earnings per unit, and statements regarding Compressco Partners' beliefs, expectations, plans, goals, future events and performance, and other statements that are not purely historical. These forward-looking statements are based on certain assumptions and analyses made by Compressco Partners in light of its experience and its perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances. Such statements are subject to a number of risks and uncertainties, many of which are beyond the control of Compressco Partners. Investors are cautioned that any such statements are not guarantees of future performances or results and that actual results or developments may differ materially from those projected in the forward-looking statements. Some of the factors that could affect actual results are described in the registration statement filed by Compressco Partners with the U.S. Securities and Exchange Commission (SEC), which is available via the SEC's web site at www.sec.gov. Compressco Partners undertakes no obligation to update or revise any forward-looking statement to reflect new information or events.

The following financial data for the three and six month periods ended June 30, 2011 includes results of Compressco Partners and results of its predecessor for the period prior to June 20, 2011; financial data for the three and six month periods ended June 30, 2010 includes results of Compressco Partners' predecessor:

Three Months Ended | Six Months Ended | |||||||

June 30, | June 30, | |||||||

2011 | 2010 | 2011 | 2010 | |||||

(In Thousands) | ||||||||

Financial data (unaudited) | ||||||||

Compression and other services | $ 19,813 | $ 19,205 | $ 39,207 | $ 38,473 | ||||

Sales of compressors and parts | 2,513 | 846 | 5,003 | 1,912 | ||||

Total revenues | 22,326 | 20,051 | 44,210 | 40,385 | ||||

Cost of revenues (excluding depreciation and amortization expense) | ||||||||

Cost of compression and other services | 10,494 | 8,213 | 20,771 | 16,662 | ||||

Cost of compressors and parts sales | 1,716 | 481 | 3,525 | 1,185 | ||||

Total cost of revenues | 12,210 | 8,694 | 24,296 | 17,847 | ||||

Selling, general and administrative expense | 3,725 | 3,675 | 7,024 | 7,003 | ||||

Depreciation and amortization | 3,191 | 3,257 | 6,370 | 6,593 | ||||

Interest expense, net | 2,388 | 3,263 | 5,111 | 6,562 | ||||

Other (income) expense, net | 127 | 92 | 216 | 78 | ||||

Income before tax provision | 685 | 1,070 | 1,193 | 2,302 | ||||

Provision for income taxes | 132 | 452 | 350 | 965 | ||||

Net income | $ 553 | $ 618 | $ 843 | $ 1,337 | ||||

Reconciliation of Non-GAAP Financial Measures

Compressco Partners includes in this release the non-GAAP financial measures EBITDA and distributable cash flow. EBITDA is used as a supplemental financial measure by the Partnership's management to: assess the Partnership's ability to generate available cash sufficient to make distributions to the Partnership's unitholders and general partner; evaluate the financial performance of its assets without regard to financing methods, capital structure or historical cost basis; measure operating performance and return on capital as compared to those of other companies in the production enhancement business; and, determine the Partnership's ability to incur and service debt and fund capital expenditures. The Partnership defines EBITDA as earnings before interest, taxes, depreciation and amortization.

Distributable cash flow is used as a supplemental financial measure by the Partnership's management as it provides important information relating to the relationship between our financial operating performance and our cash distribution capability. Additionally, the Partnership uses distributable cash flow in setting forward expectations and in communications with the board of directors of our general partner. The Partnership defines distributable cash flow as EBITDA less current income tax expense and maintenance capital expenditures, plus the non-cash cost of compressors sold and equity compensation expense.

These non-GAAP financial measures should not be considered an alternative to net income, operating income, cash flows from operating activities or any other measure of financial performance presented in accordance with GAAP. These non-GAAP financial measures may not be comparable to EBITDA, distributable cash flow or other similarly titled measures of other entities, as other entities may not calculate these non-GAAP financial measures in the same manner as Compressco Partners. Management compensates for the limitation of these non-GAAP financial measures as an analytical tool by reviewing the comparable GAAP measures, understanding the differences between the measures and incorporating this knowledge into management's decision making process. Furthermore, these non-GAAP measures should not be viewed as indicative of the actual amount of cash that Compressco Partners has available for distributions or that the Partnership plans to distribute for a given period, nor should they be equated to available cash as defined in the Partnership's partnership agreement.

The following table reconciles net income to EBITDA for the three and six month periods ended June 30, 2011 and June 30, 2010:

Three Months Ended | Six Months Ended | |||||||

June 30, | June 30, | |||||||

2011 | 2010 | 2011 | 2010 | |||||

(In Thousands) | ||||||||

Net income | $ 553 | $ 618 | $ 843 | $ 1,337 | ||||

Provision for income taxes | 132 | 452 | 350 | 965 | ||||

Depreciation and amortization | 3,191 | 3,257 | 6,370 | 6,593 | ||||

Interest | 2,388 | 3,263 | 5,111 | 6,562 | ||||

EBITDA | $ 6,264 | $ 7,590 | $ 12,674 | $ 15,457 | ||||

The following table reconciles net income to distributable cash flow for the period following the completion of the Partnership's initial public offering:

Period from June 20, 2011 | ||

to June 30, 2011 | ||

(In Thousands) | ||

Net income | $ 547 | |

Provision for income taxes | 90 | |

Depreciation and amortization | 345 | |

Interest | - | |

EBITDA | $ 982 | |

Less: | ||

Current income tax expense | (119) | |

Maintenance capital expenditures | - | |

Plus: | ||

Non-cash cost of compressors sold | 33 | |

Equity compensation | 24 | |

Distributable cash flow | $ 920 | |

SOURCE Compressco Partners, L.P.