THE WOODLANDS, Texas, June 2, 2020 /PRNewswire/ -- CSI Compressco LP ("CSI Compressco" or the "Partnership") (NASDAQ: CCLP) and the Partnership's wholly owned subsidiary, CSI Compressco Finance Inc. ("Finance Corp" and, together with the Partnership, the "Issuers") today announced that, in connection with their previously announced Exchange Offer for the Issuers' 7.250% Senior Unsecured Notes due 2022 (the "Unsecured Notes"), at least 57.9% of the Unsecured Notes are expected to be accepted for exchange.

As previously announced, Eligible Holders must tender their Unsecured Notes by 11:59 P.M., New York City time, on June 10, 2020 to be eligible to receive the Total Consideration of $900 principal amount of New First Lien Notes or, as applicable and subject to proration as described in the Offering Memorandum, $975 principal amount of New Second Lien Notes per $1,000 principal amount of Unsecured Notes. Other than as described in this announcement, the terms and conditions of the Exchange Offer remain as set forth in the Offering Memorandum.

All capitalized terms used herein have the meaning defined in the Confidential Offering Memorandum and Consent Solicitation Statement dated April 17, 2020 (as amended to the date hereof, the "Offering Memorandum").

The Issuers have entered into a support agreement (the "Support Agreement") with certain Eligible Holders (the "Supporting Holders") representing approximately $147.4 million aggregate principal amount of Unsecured Notes, or 49.8%, pursuant to which the Supporting Holders have agreed to tender all of the Unsecured Notes held by them in the Exchange Offer and not withdraw such Unsecured Notes, subject to certain conditions.

Based on the Unsecured Notes tendered to date and the Supporting Holders' commitment to tender their Unsecured Notes, approximately 57.9% of the Unsecured Notes would be tendered and accepted for exchange, comprising sufficient consents to eliminate substantially all restrictive covenants and certain of the default provisions in the indenture governing the Unsecured Notes and resulting in the issuance of $50.0 million of New First Lien Notes and approximately $113.0 million of New Second Lien Notes in the Exchange Offer.

Important Information about the Exchange Offer

Documents relating to the Exchange Offer will only be distributed to holders of Unsecured Notes who complete and return an eligibility form confirming that they are either a "qualified institutional buyer" under Rule 144A under the Securities Act of 1933, as amended (the "Securities Act") or not a "U.S. person" under Regulation S under the Securities Act (such holders, "Eligible Holders"). Noteholders who desire to complete an eligibility form should either visit the website for this purpose at https://gbsc-usa.com/eligibility/compressco/ or request instructions by sending an e-mail to contact@gbsc-usa.com or calling Global Bondholder Services Corporation the information agent for the Exchange Offer, at (866) 794-2200.

The New Notes will not be registered under the Securities Act, or any other applicable securities laws and, unless so registered, the New Notes may not be offered, sold, pledged or otherwise transferred within the United States or to or for the account of any U.S. person, except pursuant to an exemption from the registration requirements thereof. Accordingly, the New Notes are being offered and issued only (i) to persons reasonably believed to be "qualified institutional buyers" (as defined in Rule 144A under the Securities Act) and (ii) to non-"U.S. persons" who are outside the United States (as defined in Regulation S under the Securities Act).

The complete terms and conditions of the Exchange Offer are set forth in the informational documents relating to the Exchange Offer. This press release is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell the New Notes. The Exchange Offer is only being made pursuant to the Offering Memorandum and the related letter of transmittal. The Exchange Offer is not being made to holders of Unsecured Notes in any jurisdiction in which the making or acceptance thereof would not be in compliance with the securities, blue sky or other laws of such jurisdiction.

Cautionary Note Regarding Forward-Looking Statements

Certain information included in this press release contains statements that are forward-looking. The words "believe," "may," "will," "aim," "estimate," "continue," "anticipate," "intend," "plan," "expect," "should" and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short term and long-term business operations and objectives, and financial needs. Factors that could cause such differences in future results include, but are not limited to, the risks described in the Offering Memorandum related to the Exchange Offer.

About CSI Compressco LP

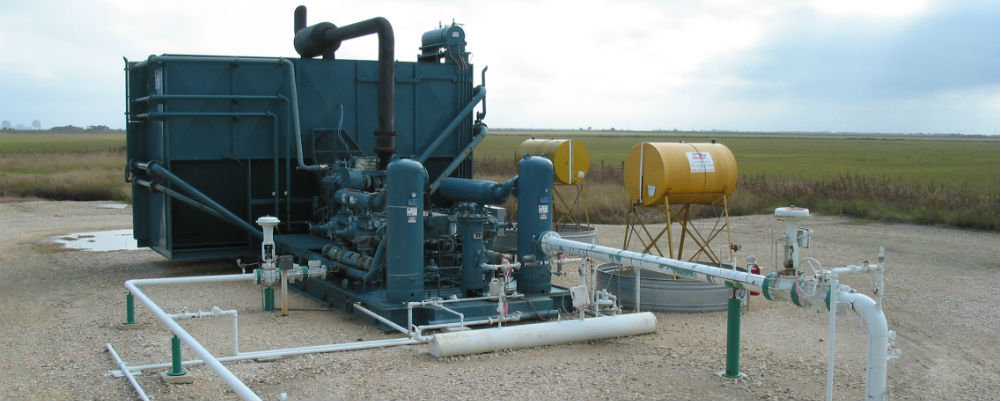

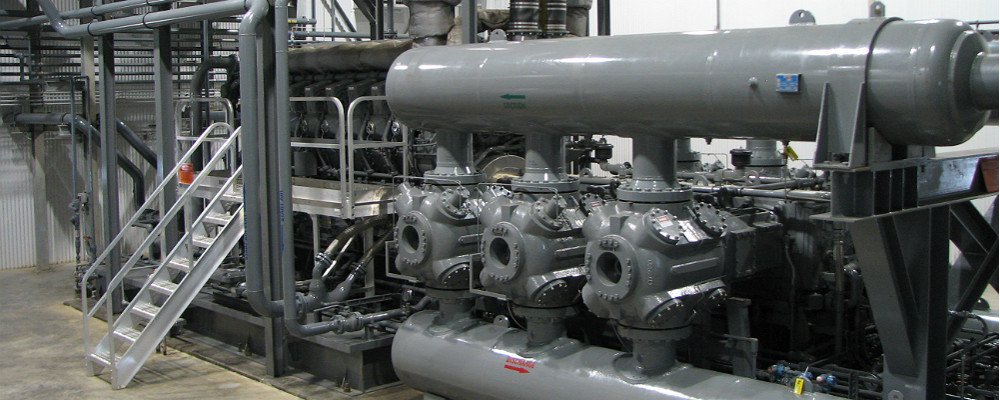

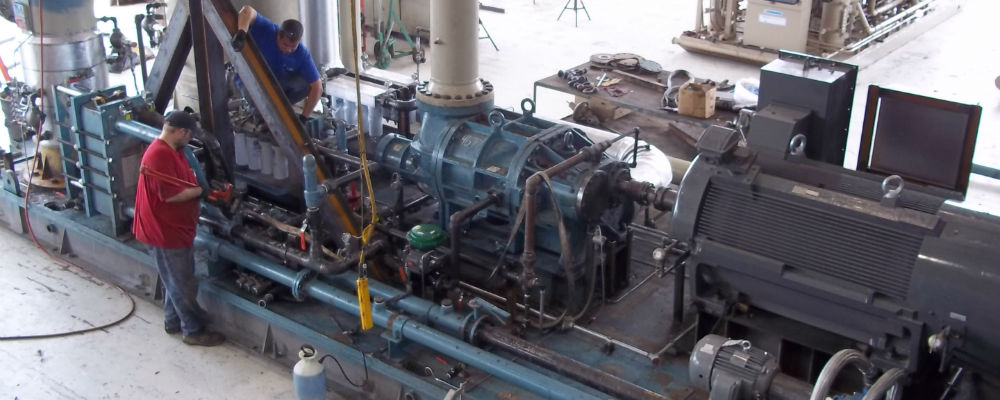

CSI Compressco is a provider of compression services and equipment for natural gas and oil production, gathering, artificial lift, transmission, processing, and storage. CSI Compressco's compression and related services business includes a fleet of more than 5,200 compressor packages providing approximately 1.19 million in aggregate horsepower, utilizing a full spectrum of low-, medium- and high-horsepower engines. CSI Compressco also provides well monitoring and automated sand separation services in conjunction with compression and related services in certain Latin American markets. CSI Compressco's aftermarket business provides compressor package reconfiguration and maintenance services, as well as the sale of compressor package parts and components manufactured by third-party suppliers. CSI Compressco's customers comprise a broad base of natural gas and oil exploration and production, midstream, transmission, and storage companies operating throughout many of the onshore producing regions of the United States, as well as in a number of foreign countries, including Mexico, Canada and Argentina. CSI Compressco is managed by CSI Compressco GP Inc., which is an indirect, wholly owned subsidiary of TETRA Technologies, Inc. (NYSE: TTI).

SOURCE CSI Compressco LP