THE WOODLANDS, Texas, May 9, 2017 /PRNewswire/ -- CSI Compressco LP ("CSI Compressco" or the "Partnership") (NASDAQ: CCLP) today announced first quarter 2017 consolidated financial results.

Highlights include:

- Net loss of $15.6 million, including $1.9 million unfavorable non-cash fair market value adjustment to the Series A Preferred

- Adjusted EBITDA(1) of $19.9 million including approximately $1 million of costs to prepare idle fleet equipment for deployment

- Cash distribution of $0.1875 per common unit, reduced 50% from the prior quarter, with the excess cash flow to be used to reduce the outstanding balance of our revolving credit facility

- Compression fleet utilization improved 60 basis points compared to prior quarter

- Aftermarket services revenue of $9.4 million, a $2.5 million (36%) increase compared to prior quarter

- New equipment sales orders received totaling $5 million, with backlog of $23.8 million, an increase of $2.2 million compared to prior quarter

- Revolving credit facility was amended to increase the maximum total leverage ratio to 6.75x as of June 30, 2017 and September 30, 2017, 6.50x as of December 31, 2017 and March 31, 2018, 6.25x as of June 30, 2018 and September 30, 2018, 6.00x as of December 31, 2018, and 5.75x thereafter

|

Three Months Ended | |||||

|

Mar 31, 2017 |

Dec 31, 2016 |

Mar 31, 2016 | |||

|

(In Thousands, Except Distributions per Unit and Ratios) | |||||

|

Net loss |

$ (15,593) |

$ (12,138) |

$ (105,349) | ||

|

Adjusted EBITDA(1) |

$ 19,873 |

$ 21,682 |

$ 25,442 | ||

|

Distributable cash flow(1) |

$ 7,093 |

$ 8,798 |

$ 14,232 | ||

|

Quarterly cash distribution per unit |

$ 0.1875 |

$ 0.3775 |

$ 0.3775 | ||

|

Distribution coverage ratio(1) |

1.09x |

0.68x |

1.11x | ||

|

Fleet growth capital expenditures |

$ - |

$ - |

$ 436 | ||

|

Net cash provided by operating activities |

$ 1,821 |

$ 15,922 |

$ 15,095 | ||

|

Free cash flow(1) |

$ (5,394) |

$ 12,865 |

$ 13,742 | ||

|

(1) Non-GAAP financial measures reconciled to the nearest GAAP number on Schedules B and C. |

Consolidated revenues for the quarter ended March 31, 2017, were $65.6 million compared to $82.9 million for the fourth quarter of 2016 and $81.7 million for the first quarter of 2016, with equipment sales declining $18.9 million sequentially and $5.0 million year-over-year. Pre-tax loss for the quarter ended March 31, 2017 was $14.8 million, inclusive of an unfavorable $1.9 million non-cash adjustment to the fair market value of the Series A Preferred, compared to $11.8 million for the fourth quarter of 2016 and $104.7 million for the first quarter of 2016 (which included $92.3 million of goodwill impairment charges).

As of March 31, 2017, aggregate compression services fleet horsepower totaled 1,108,523 horsepower and the fleet utilization rate was 77.0%. Utilization of our highest horsepower segment, equipment above 800 horsepower, was at 87.0% at the end of March 2017. We define the fleet utilization rate as the aggregate compressor package horsepower in service divided by the aggregate compressor package fleet horsepower as of a given date. We do not exclude idle horsepower under repair or horsepower that is otherwise impaired from our calculation of utilization rate.

Unaudited results of operations for the quarter ended March 31, 2017 compared to the prior quarter and the corresponding prior year quarter are presented in the accompanying financial tables.

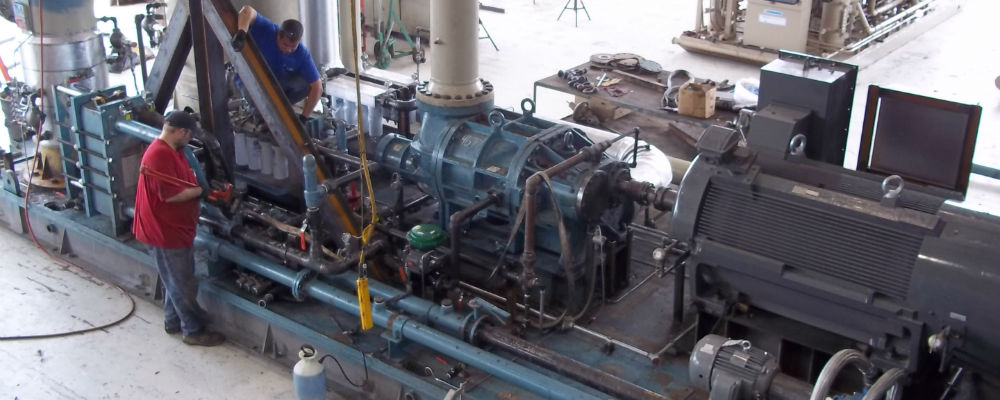

Timothy A. Knox, President of CSI Compressco, commented, "While we appear to be in the early stages of an improving market, excess capacity in our industry has made it difficult to recover the price concessions made over the past two years in the compression services business. We expect that as our service fleet utilization continues to improve in response to anticipated gains in commodity prices and as drilling and completions activity increases, we will be able to improve pricing in the coming quarters. In response to increased inquiries and quotations for compression services, we initiated a program in the first quarter to prepare and make ready some of our idle equipment to quickly deploy those assets as opportunities materialize. As a result, our first quarter results include approximately $1 million of operating expenses for this initiative.

"As of March 31, 2017, 853,200 horsepower of our total compression services fleet was generating revenue, an increase of 1,467 horsepower compared to prior quarter end, while fleet utilization increased 60 basis points from 76.4% in the fourth quarter of 2016 to 77.0% at the end of March 2017. This marks the second consecutive quarter of improvement in both horsepower generating revenue and fleet utilization. Aftermarket services revenues were strong in the first quarter of 2017 at $9.4 million and current activities lead us to believe that this business will continue to improve in 2017 when compared to the prior year. During the first quarter of 2017 we received equipment sales orders totaling $5 million, bringing our total back log to $23.8 million at the end of March, the majority of which we expect to deliver in the second half of 2017.

"As a result of the slower than anticipated recovery in our services and sales business, which is further exacerbated by current weak pricing, we reduced our distributions by 50% for the first quarter to a rate equivalent to $0.75 per common unit per year with the intention of reducing outstanding debt. In addition, we completed an amendment to our revolving credit facility whereby the total leverage ratio was increased to 6.75x through September 30, 2017, to 6.50x through March 31, 2018, to 6.25x through September 30, 2018, to 6.00x through December 31, 2018 and 5.75x thereafter. In connection with the amendment, the board of directors of the General Partner adopted resolutions limiting the Partnership's cash distributions payable on its common units to no more than $0.1875 per common unit for the quarterly period ending June 30, 2017. The revolver commitment remains unchanged at $315 million. We believe the actions of reducing the distribution and amending our revolving credit facility covenants will provide us the balance sheet flexibility to address opportunities as they present themselves and remain compliant with our covenant obligations.

"Our total capital expenditure forecast for 2017 is $15 million to $30 million, which is consistent with our prior guidance, which is inclusive of maintenance capital expenditures that are now projected to be $12 million to $15 million for the year."

Conference Call

CSI Compressco will host a conference call to discuss first quarter 2017 results today, May 9, 2017, at 10:30 a.m. Eastern Time. The phone number for the call is 866-374-8397. The conference will also be available by live audio webcast and may be accessed through the CSI Compressco website at www.csicompressco.com.

First Quarter 2017 Cash Distribution on Common Units

On April 21, 2017, CSI Compressco announced that the board of directors of its general partner declared a cash distribution attributable to the first quarter of 2017 of $0.1875 per outstanding common unit, which will be paid on May 15, 2017 to common unitholders of record as of the close of business on May 1, 2017. The distribution coverage ratio (which is a Non-GAAP Financial Measure defined and reconciled to the closest GAAP financial measure below) for the first quarter of 2017 was 1.09x.

CSI Compressco Overview

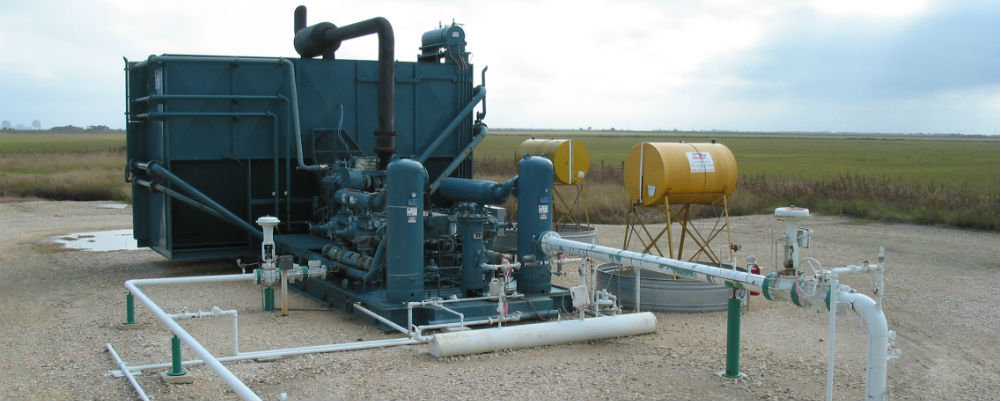

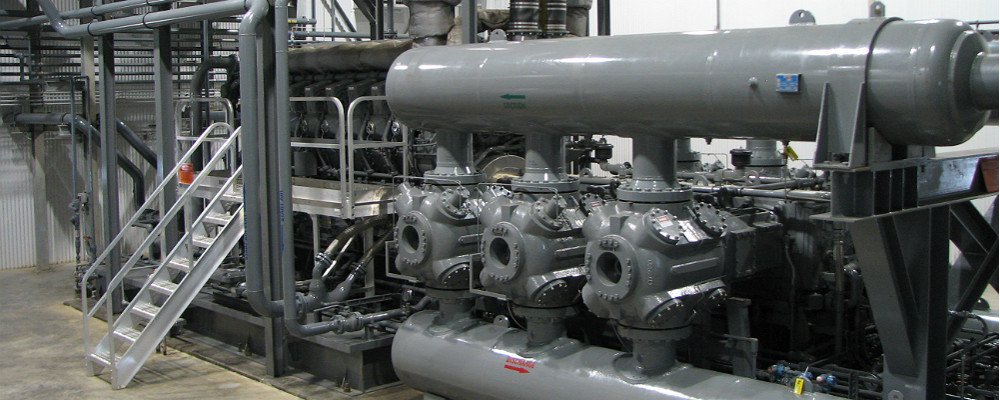

CSI Compressco is a provider of compression services and equipment for natural gas and oil production, gathering, transportation, processing, and storage. CSI Compressco's compression and related services business includes a fleet of more than 5,800 compressor packages providing approximately 1.1 million in aggregate horsepower, utilizing a full spectrum of low, medium, and high horsepower engines. CSI Compressco also provides well monitoring and automated sand separation services in conjunction with compression services in Mexico. CSI Compressco's equipment sales business includes the fabrication and sale of standard compressor packages, custom-designed compressor packages, and oilfield fluid pump systems designed and fabricated primarily at our facility in Midland, Texas. CSI Compressco's aftermarket business provides compressor package reconfiguration and maintenance services as well as the sale of compressor package parts and components manufactured by third-party suppliers. CSI Compressco's customers comprise a broad base of natural gas and oil exploration and production, mid-stream, transmission, and storage companies operating throughout many of the onshore producing regions of the United States as well as in a number of foreign countries, including Mexico, Canada, and Argentina. CSI Compressco is managed by CSI Compressco GP Inc., which is an indirect, wholly owned subsidiary of TETRA Technologies, Inc. (NYSE: TTI).

Forward Looking Statements

This press release contains "forward-looking statements" and information based on our beliefs and those of our general partner, CSI Compressco GP Inc. Forward-looking statements in this press release are identifiable by the use of the following words and other similar words: "anticipates", "assumes", "believes", "budgets", "could", "estimates", "expects", "forecasts", "goal", "intends", "may", "might", "plans", "predicts", "projects", "schedules", "seeks", "should", "targets", "will" and "would". These forward-looking statements include statements, other than statements of historical fact, concerning the recovery of the oil and gas industry and CSI Compressco's strategy, future operations, financial position, estimated revenues, negotiations with our bank lenders, projected costs and other statements regarding CSI Compressco's beliefs, expectations, plans, prospects, and other future events and performance. Such forward-looking statements reflect our current views with respect to future events and financial performance and are based on assumptions that we believe to be reasonable but such forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to: economic and operating conditions that are outside of our control, including the supply, demand, and prices of crude oil and natural gas; the levels of competition we encounter; the activity levels of our customers; the availability of adequate sources of capital to us; our ability to comply with contractual obligations, including those under our financing arrangements; our operational performance; the loss of our management; risks related to acquisitions and our growth strategy, including our 2014 acquisition of Compressor Systems, Inc.; the availability of raw materials and labor at reasonable prices; risks related to our foreign operations; the effect and results of litigation, regulatory matters, settlements, audits, assessments, and contingencies; or potential material weaknesses in the future; information technology risks, including the risk of cyberattack; and other risks and uncertainties contained in our Annual Report on Form 10-K and our other filings with the U.S. Securities and Exchange Commission ("SEC"), which are available free of charge on the SEC website at www.sec.gov. The risks and uncertainties referred to above are generally beyond our ability to control and we cannot predict all the risks and uncertainties that could cause our actual results to differ from those indicated by the forward-looking statements. If any of these risks or uncertainties materialize, or if any of the underlying assumptions prove incorrect, actual results may vary from those indicated by the forward-looking statements, and such variances may be material. All subsequent written and oral forward-looking statements made by or attributable to us or to persons acting on our behalf are expressly qualified in their entirety by reference to these risks and uncertainties. You should not place undue reliance on forward-looking statements. Each forward-looking statement speaks only as of the date of the particular statement, and we undertake no obligation to update or revise any forward-looking statements we may make, except as may be required by law.

|

Schedule A - Income Statement | ||||||

|

Results of Operations (unaudited) |

Three Months Ended |

|||||

|

Mar 31, 2017 |

Dec 31, 2016 |

Mar 31, 2016 |

||||

|

(in Thousands, Except per Unit Amounts) | ||||||

|

Revenues: |

||||||

|

Compression and related services |

$ 50,497 |

$ 51,395 |

$ 62,411 |

|||

|

Aftermarket services |

9,387 |

6,900 |

8,587 |

|||

|

Equipment sales |

5,668 |

24,573 |

10,694 |

|||

|

Total revenues |

65,552 |

82,868 |

81,692 |

|||

|

Cost of revenues (excluding depreciation and amortization expense): |

||||||

|

Cost of compression and related services |

29,043 |

28,628 |

31,805 |

|||

|

Cost of aftermarket services |

7,622 |

5,730 |

6,618 |

|||

|

Cost of equipment sales |

5,396 |

24,337 |

9,953 |

|||

|

Total cost of revenues |

42,061 |

58,695 |

48,376 |

|||

|

Depreciation and amortization |

17,295 |

17,107 |

18,452 |

|||

|

Impairments of long-lived assets |

— |

2,357 |

7,866 |

|||

|

Selling, general, and administrative expense |

8,766 |

8,530 |

10,230 |

|||

|

Goodwill Impairment |

— |

— |

92,334 |

|||

|

Interest expense, net |

10,383 |

10,621 |

8,802 |

|||

|

Series A Preferred fair value adjustment |

1,865 |

(2,162) |

— |

|||

|

Other (income)/expense, net |

(38) |

(510) |

288 |

|||

|

Income (loss) before income tax provision |

(14,780) |

(11,770) |

(104,656) |

|||

|

Provision (benefit) for income taxes |

813 |

368 |

693 |

|||

|

Net income (loss) |

$ (15,593) |

$ (12,138) |

$ (105,349) |

|||

|

Net income per diluted common unit |

$ (0.46) |

$ (0.36) |

$ (3.11) |

|||

Reconciliation of Non-GAAP Financial Measures

The Partnership includes in this release the non-GAAP financial measures Adjusted EBITDA, distributable cash flow, distribution coverage ratio, and free cash flow. Adjusted EBITDA is used as a supplemental financial measure by the Partnership's management to:

- assess the Partnership's ability to generate available cash sufficient to make distributions to the Partnership's unitholders and general partner;

- evaluate the financial performance of its assets without regard to financing methods, capital structure or historical cost basis;

- measure operating performance and return on capital as compared to those of our competitors;

- determine the Partnership's ability to incur and service debt and fund capital expenditures; and

- monitor the financial performance measure used in the Partnership's bank credit facility financial covenant.

The Partnership defines Adjusted EBITDA as earnings before interest, taxes, depreciation and amortization, and before certain non-cash charges consisting of impairments, bad debt expense attributable to bankruptcy of customer, non-cash costs of compressors sold, equity compensation, fair value adjustments of our Preferred Units, gain on extinguishment of debt, administrative expenses under the Omnibus Agreement paid in equity using common units and excluding acquisition and transaction costs, and severance expense.

Distributable cash flow is used as a supplemental financial measure by the Partnership's management as it provides important information relating to the relationship between our financial operating performance and our cash distribution capability. Additionally, the Partnership uses distributable cash flow in setting forward expectations and in communications with the board of directors of our general partner. The Partnership defines distributable cash flow as Adjusted EBITDA less current income tax expense, maintenance capital expenditures, interest expense, and severance expense, plus non-cash interest expense.

The Partnership believes that the distribution coverage ratio provides important information relating to the relationship between the Partnership's financial operating performance and its cash distribution capability. The Partnership defines the distribution coverage ratio as the ratio of distributable cash flow to the total quarterly distribution payable, which includes, as applicable, distributions payable on all outstanding common units, the general partner interest, and the general partner's incentive distribution rights.

The Partnership defines free cash flow as net cash provided by operating activities less capital expenditures, net of sales proceeds. Management primarily uses this metric to assess our ability to retire debt, evaluate our capacity to further invest and grow, and measure our performance as compared to our peer group of companies.

These non-GAAP financial measures should not be considered an alternative to net income, operating income, cash flows from operating activities or any other measure of financial performance presented in accordance with GAAP. These non-GAAP financial measures may not be comparable to Adjusted EBITDA, distributable cash flow, free cash flow or other similarly titled measures of other entities, as other entities may not calculate these non-GAAP financial measures in the same manner as CSI Compressco. Management compensates for the limitation of these non-GAAP financial measures as an analytical tool by reviewing the comparable GAAP measures, understanding the differences between the measures and incorporating this knowledge into management's decision making process. Furthermore, these non-GAAP measures should not be viewed as indicative of the actual amount of cash that CSI Compressco has available for distributions or that the Partnership plans to distribute for a given period, nor should they be equated to available cash as defined in the Partnership's partnership agreement.

The following table reconciles net income (loss) to Adjusted EBITDA, distributable cash flow and distribution coverage ratio for the three month periods ended March 31, 2017, December 31, 2016 and March 31, 2016:

|

Schedule B - Reconciliation of Net Income to Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio | |||||

|

Results of Operations (unaudited) |

Three Months Ended | ||||

|

Mar 31, 2017 |

Dec 31, 2016 |

Mar 31, 2016 | |||

|

(In Thousands) | |||||

|

Net income (loss) |

$ (15,593) |

$ (12,138) |

$ (105,349) | ||

|

Interest expense, net |

10,383 |

10,621 |

8,802 | ||

|

Provision for income taxes |

813 |

368 |

693 | ||

|

Depreciation and amortization |

17,295 |

17,107 |

18,452 | ||

|

Impairments of long-lived assets |

— |

2,357 |

7,866 | ||

|

Goodwill Impairment |

— |

— |

92,334 | ||

|

Non-cash cost of compressors sold |

2,316 |

3,941 |

1,765 | ||

|

Equity Compensation |

956 |

792 |

636 | ||

|

Series A Preferred transaction costs |

37 |

85 |

— | ||

|

Series A Preferred fair value adjustments |

1,865 |

(2,162) |

— | ||

|

Gain on extinguishment of debt |

— |

(865) |

— | ||

|

Omnibus expense paid or to be paid in equity |

1,746 |

1,576 |

— | ||

|

Severance |

55 |

— |

243 | ||

|

Adjusted EBITDA |

$ 19,873 |

$ 21,682 |

$ 25,442 | ||

|

Less: |

|||||

|

Current income tax expense |

691 |

608 |

548 | ||

|

Maintenance capital expenditures |

4,580 |

4,840 |

2,313 | ||

|

Interest Expense |

10,383 |

10,621 |

8,802 | ||

|

Severance |

55 |

— |

243 | ||

|

Plus: |

|||||

|

Non-cash interest expense |

2,929 |

3,185 |

696 | ||

|

Distributable cash flow |

$ 7,093 |

$ 8,798 |

$ 14,232 | ||

|

Cash distribution attributable to period |

$ 6,512 |

$ 12,870 |

$ 12,784 | ||

|

Distribution coverage ratio |

1.09x |

0.68x |

1.11x | ||

The following table reconciles net cash provided by operating activities to free cash flow for the three month periods ended March 31, 2017, December 31, 2016 and March 31, 2016:

|

Schedule C - Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow | |||||

|

Three Months Ended | |||||

|

Mar 31, 2017 |

Dec 31, 2016 |

Mar 31, 2016 | |||

|

(In Thousands) | |||||

|

Net cash provided by operating activities |

$ 1,821 |

$ 15,922 |

$ 15,095 | ||

|

Capital expenditures, net of sales proceeds |

(7,215) |

(3,057) |

(1,353) | ||

|

Free cash flow |

$ (5,394) |

$ 12,865 |

$ 13,742 | ||

SOURCE CSI Compressco LP