MIDLAND, Texas, Sept. 21, 2016 /PRNewswire/ -- CSI Compressco LP (NASDAQ: CCLP) (the "Partnership") announced today that it has completed private placements of $30 million of Series A Convertible Preferred Units ("Preferred Units") as a follow on to the previously announced $50 million offering of such securities completed on August 8, 2016. These placements were completed at a cash purchase price of $11.43 per unit under the same terms and conditions as the prior placement.

The Partnership will receive proceeds of approximately $29 million, after expenses, from these follow on offerings and intends to use the proceeds to reduce outstanding indebtedness, including the repurchase of outstanding senior notes as market conditions permit. Evercore Group L.L.C. and RBC Capital Markets, LLC acted as the Partnership's financial advisors for these transactions.

"The $80 million of capital from the original and follow on offerings will allow us to strengthen our balance sheet as we manage through this extended downturn," CSI Compressco President, Timothy Knox said.

The Preferred Units will pay quarterly distributions in additional Preferred Units equal to an annual rate of 11.00% of the issue price, subject to adjustment. Beginning March 2017, a ratable portion of the Preferred Units will convert into common units monthly over a total of thirty months. The Partnership has the option to satisfy a portion of the monthly conversions with cash payments, subject to certain restrictions. In addition, the Preferred Units will be convertible into common units, generally on a one-for-one basis, subject to adjustment, at the holders' option after May 31, 2017.

The securities offered in the private placement have not been registered under the Securities Act of 1933, as amended (the "Securities Act"), or applicable state securities laws, and accordingly may not be offered or sold in the United States except pursuant to an effective registration statement or an applicable exemption from the registration requirements of the Securities Act and such applicable state securities laws. The Partnership is required to file a registration statement with the SEC for the resale of the common units underlying the Preferred Units by the purchasers within 90 days after the closing date. The Purchase Agreement includes representations, warranties, covenants and other terms typical of a transaction of this type. A full description of the offerings can be reviewed in documents attached to the Partnership's Current Reports on Form 8-K filed with the SEC on August 8, 2016 and on the date hereof. You may also obtain these documents for free when they are available by visiting the SEC's web site at www.sec.gov.

This press release does not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which the offer, solicitation or sale of these securities would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About CSI Compressco

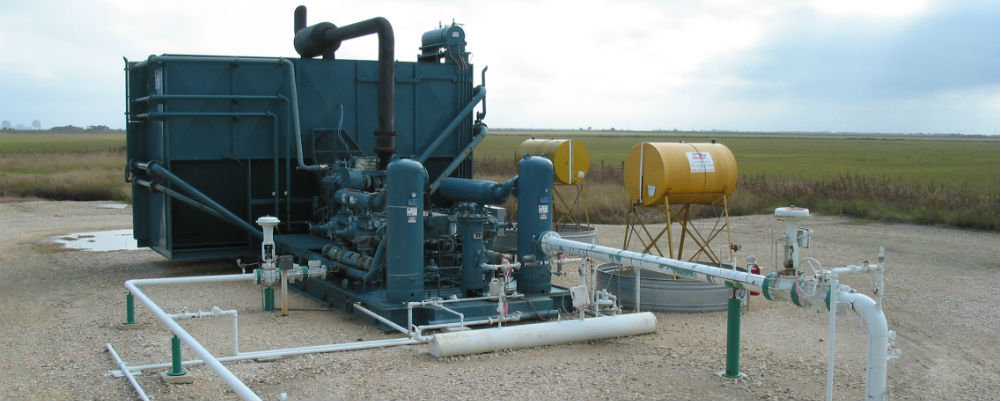

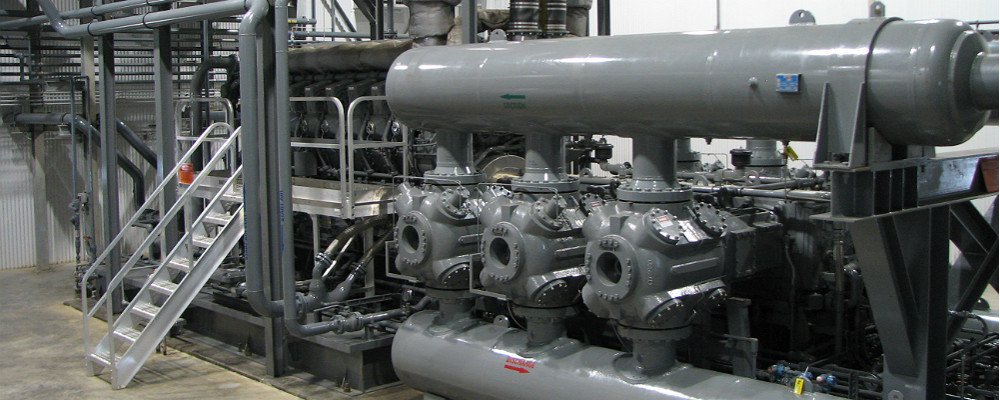

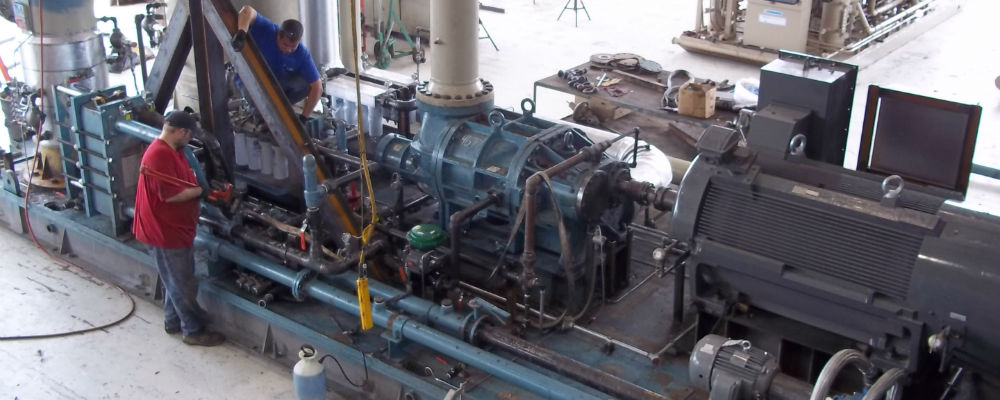

CSI Compressco is a provider of compression services and equipment for natural gas and oil production, gathering, transportation, processing, and storage. CSI Compressco's compression and related services business includes a fleet of over 6,000 compressor packages with in excess of 1.1 million in aggregate horsepower, utilizing a full spectrum of low-, medium-, and high-horsepower engines. CSI Compressco also provides well monitoring and automated sand separation services in conjunction with compression services in Mexico. CSI Compressco's equipment sales business includes the fabrication and sale of standard compressor packages, custom-designed compressor packages, and oilfield fluid pump systems designed and fabricated primarily at our facility in Midland, Texas. CSI Compressco's aftermarket business provides compressor package reconfiguration and maintenance services as well as the sale of compressor package parts and components manufactured by third-party suppliers. CSI Compressco's customers comprise a broad base of natural gas and oil exploration and production, mid-stream, transmission, and storage companies operating throughout many of the onshore producing regions of the United States as well as in a number of foreign countries, including Mexico, Canada, and Argentina. CSI Compressco is managed by CSI Compressco GP Inc., which is an indirect, wholly owned subsidiary of TETRA Technologies, Inc. (NYSE: TTI).

Forward Looking Statements

This press release contains "forward-looking statements" and information based on our beliefs and those of our general partner, CSI Compressco GP Inc. Forward-looking statements in this press release are identifiable by the use of the following words and other similar words: "anticipates", "assumes", "believes", "budgets", "could", "estimates", "expects", "forecasts", "goal", "intends", "may", "might", "plans", "predicts", "projects", "schedules", "seeks", "should", "targets", "will" and "would". These forward-looking statements include statements, other than statements of historical fact, concerning CSI Compressco's strategy, future operations, financial position, estimated revenues, negotiations with our bank lenders, projected costs and other statements regarding CSI Compressco's beliefs, expectations, plans, prospects, and other future events and performance. Such forward looking statements reflect our current views with respect to future events and financial performance and are based on assumptions that we believe to be reasonable but such forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to: economic and operating conditions that are outside of our control, including the supply, demand, and prices of crude oil and natural gas; the levels of competition we encounter; the activity levels of our customers; the availability of adequate sources of capital to us; our ability to comply with contractual obligations, including those under our financing arrangements; our operational performance; the loss of our management; risks related to acquisitions and our growth strategy, including our 2014 acquisition of Compressor Systems, Inc.; the availability of raw materials and labor at reasonable prices; risks related to our foreign operations; the effect and results of litigation, regulatory matters, settlements, audits, assessments, and contingencies; risks associated with a material weakness in our internal control over financial reporting and the consequences we may encounter if we are unable to remediate that material weakness or if we identify other material weaknesses in the future; information technology risks, including the risk of cyberattack; and other risks and uncertainties contained in our Annual Report on Form 10-K and our other filings with the U.S. Securities and Exchange Commission ("SEC"), which are available free of charge on the SEC website at www.sec.gov. The risks and uncertainties referred to above are generally beyond our ability to control and we cannot predict all the risks and uncertainties that could cause our actual results to differ from those indicated by the forward-looking statements. If any of these risks or uncertainties materialize, or if any of the underlying assumptions prove incorrect, actual results may vary from those indicated by the forward-looking statements, and such variances may be material. All subsequent written and oral forward-looking statements made by or attributable to us or to persons acting on our behalf are expressly qualified in their entirety by reference to these risks and uncertainties. You should not place undue reliance on forward-looking statements. Each forward-looking statement speaks only as of the date of the particular statement, and we undertake no obligation to update or revise any forward-looking statements we may make, except as may be required by law.

SOURCE CSI Compressco LP